What Is An Exclusive Listing?

From the Desk of Ralph Fox | Foreign Investor Tax in Toronto

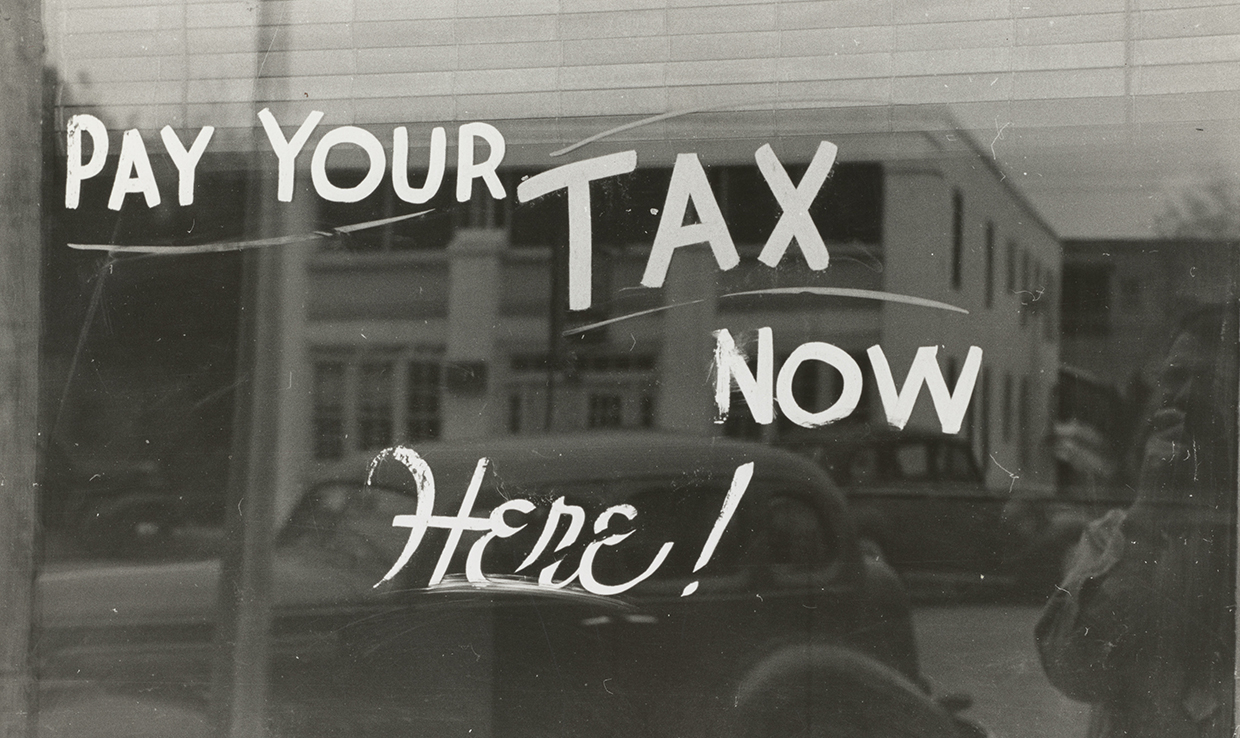

The hot-button topic in Toronto Real Estate is the possibility of a Foreign Investment Tax being implemented in Ontario, similar to what has been enacted in British Columbia. The mass media and many Canadians, have been calling for a silver bullet from the Government to slow down the erosion of affordability in Toronto and Vancouver’s housing markets; but, is the best solution exclusively taxing and potentially deterring the same Foreign Investors who contribute to the success of our economy?

The BC government’s 15% Foreign Investor Tax is more about show business and politics than it is about effectively curtailing market forces; and, the call for a Foreign Investor Tax is blatantly being aimed at Chinese investors and immigrants. Blaming the Chinese for our “housing woes” is racist, protectionist, and simply put bad for business. Much like the problems facing the US today, there is no quick fix in blaming foreign elements as the source skyrocketing real estate prices. These issues are far too complex and deep-rooted for a single determining factor.

Up here in Canada, we tend to feel that we are above the political circus happening in the US; but, we are beginning to see similarities to the US political climate where Donald Trump is blaming foreigners as a means of diverting attention from the real and unshakeable problems that America is facing. Spewing comments like, “We can’t continue to allow China to rape our country, that’s what they’re doing. It’s the greatest theft in the history of the world” is a prime example. Putting the blame on someone different from yourself rather than dealing with the issues you don’t have the depth, patience or facts to deal with effectively, is nothing more than a destructive defence mechanism. It is easier to point to an individual group and raise a tax as opposed to taking responsibility and doing what is sorely needed to effectively come up with a solution to providing affordable housing in the long term.

It is estimated by the CMHC (Canadian Mortgage and Housing Corporation) that foreign ownership of condos in Toronto in 2015 is at 3.3%. To evaluate the depth of this percentage critically, one must consider all the variables. On average there are 100,000 real estate transactions in Toronto annually, which means we are talking about less than 3,500 transactions a year. Therefore, the reality of the impact that foreign buyers have on residential housing markets in Toronto is relatively minuscule.

Traditionally one of the biggest drivers of foreign residential real estate investment is that purchasing overseas is often a precursor to moving to that country.

The United Nations named Toronto as the most multicultural city in the world. Every year 100,000 new immigrants move to Toronto. As Torontonian’s, this is something we should be proud of, and we should also recognise that this significant level of immigration is the engine that is driving the dynamic and explosive growth of our city.

The Liberal Government under Justin Trudeau swept into power on the premises of making Canada an open and inclusive society. The Liberal Government has promised to raise immigration levels this year alone to over 300,000 people; a record setting number for Canada. Implementing tax levies can directly negate that possibility and with that in mind, what kind of paradoxical message are we sending to the world?? Immigration and foreign investments in both Ontario Real Estate and Business are what is necessary to build up a stronger economy and greater cities. If we close the doors to foreign business, that is going to resonate throughout the economy.

Ben Myers, SVP of Market Research & Analytics at Fortress Real Developments recently and accurately wrote: “Restrictive actions on foreign property ownership have yet to cool housing markets in London, Sydney and Auckland, as higher foreign buyer transaction activity is a reaction to high prices, not the cause of high prices.” As Ben demonstrates, correlation does not equal causation.

These tax levies are not only ineffective at stagnating housing prices, but they have also incidentally given rise to unbidden issues surrounding xenophobia, protectionism, and infringement of individual property rights. Furthermore, it may also be a legal issue, directly infringing upon NAFTA and other treaties with major trading partners. These are the costs that Canada must consider when prematurely furthering its restrictive measures as a solution to a problem we don’t yet fully understand.

In my experience, when foreign money is invested in Toronto Real Estate, it is invested via family members who are Canadian citizens with Canadian bank accounts making the origins of the money near impossible to track. Even if the tax is implemented, motivated foreign investors will still find ways of investing their money in our local real estate markets without paying the tax either through family, business partnerships or incorporated companies. If implemented, this tax will cause far more harm than it will generate in revenue.

Similar to Toronto, high prices in these major housing markets are the result of issues with supply and not demand; hence, Government legislation that is aimed to curtail demand on a small segment of the market will not have any long-lasting effects on curbing rising real estate prices in growing cosmopolitan city centres. The focus and attention on foreign investment in many of these markets are often misdirected from the real issue, which is the easing of supply.

Contrary to what is being perpetrated in the mass media, the attention should be focused on inadequate supply, rather than increased demand that is driving prices higher in Toronto. Everyone is quick to call on the Government for “immediate action” to cool the demand, but no-one is addressing the real issue by calling for measures that would allow for more supply.

Benjamin Tal, Deputy Chief Economist for CIBC, elaborates, “We’re in a situation where the main issue—lack of land—is a supply problem and yet we’re trying to tackle that problem with a demand tool. In Toronto, planning initiatives from decades ago—created to protect the area’s green-belt—are now restricting where housing can be built. This is the main reason for increased housing prices.”

Because of the Greenbelt surrounding the city, Toronto essentially can be viewed as an island, and the remaining availability of land is being choked while simultaneously driving up prices and forcing development to build up as opposed to out. Contrary to what is currently being proposed by the Province, expanding the Greenbelt even further is hardly a rational solution to the financial and tax issues accompanying population growth.

In Vancouver, the real fundamental problem is that even though it’s technically not an island, expansion is physically restricted given the city is mostly enclosed by water. The Vancouver market recently “cooled-down” not because of the foreign buyer taxes that they have implemented, but because of the perception of that tax and the manner in which it was implemented. As a result, investors and buyers have lost short-term confidence in the market with a wait-and-see attitude. In the long run, every instance where these types of taxes have been implemented illustrate that there has been no long-term benefit because the issue of supply has not been sufficiently addressed. Unless Government intervention can ease supply, people will continue to want to live in Vancouver and pursue the “Vancouver lifestyle.”

The advantage that Toronto has over Vancouver is that we have the ability to expand and un-become an island, so-to-speak. Although the issues in both provinces may be similar, Toronto has the leverage to resolve the problem in an easier and more efficient way than Vancouver can.

Many alternative solutions can be implemented to address issues surrounding supply; and, to name a few, the City could consider:

Thus far, the Wynne Government in Ontario has shown a complete inability to make rational policy decisions and more than likely will be susceptible to making an ill-informed, impulsive decision based on polls rather than on fact, or in the best interest of the Province. Should the Ontario Government in its infinite wisdom institute a foreign tax, we as a city and as a nation will be far worse off.

We do not need to make Toronto great again because we already are! Yes, our Real Estate is becoming expensive, but as anyone who lives in a major city knows, this is a fact of life. The bottom line is that there are no silver bullets here and only through a combination of intelligent government policy, justified taxation, and investment in infrastructure can we make the opportunity for home ownership more affordable and accessible to its residents.

-RF

Looking for more market updates? Check out other articles From the Desk of Ralph Fox