Has The Toronto Bubble Finally, Popped?

For the last two decades, the mass media and many so-called experts have been calling for the Toronto Real Estate Market to crash. Yet, the market continues to increase year over year at an annual clip of approximately +6%. Indeed, there must be some underlying factors that are causing prices to rise? Once you grasp the underlying fundamentals that have led the market to behave in this manner, it will give you greater context to understand what has been causing the price growth and how it could impact Toronto’s future trajectory. As my grade twelve history teacher use to say, you must know your history to predict the future!

1/ THE GREEN BELT:

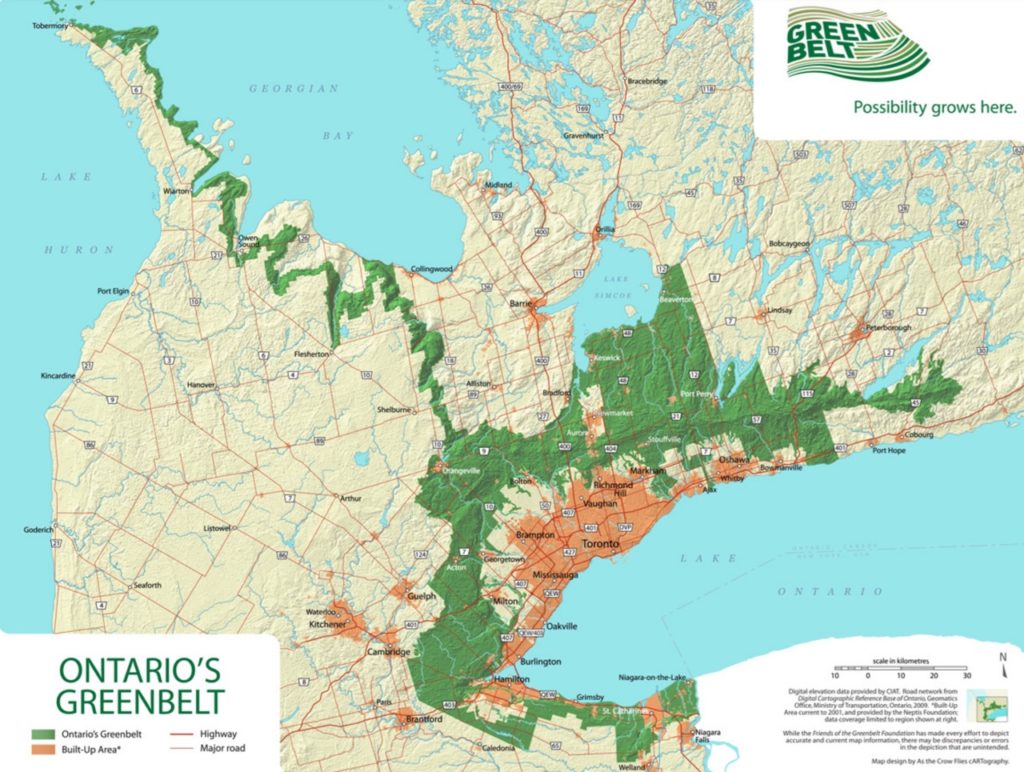

In 2005 the Liberal Government of Ontario passed legislation to limit urban sprawl and safeguard Green lands. By protecting 2 million acres of farmland, forests, wetlands, rivers and lake lands, the government essentially “formed an insulated belt” around the GTA. This shielded belt encloses a significant portion of Canada’s most populated and fastest-growing areas, and successive Governments have remained committed to its permanent protection. If you consider Lake Ontario, situated to the South, it has had effectively made Toronto an island within itself – no developable land to the North, East, West or South. The Great Toronto Area intends to grow upwards rather than outwards with more densification and population growth. Think New York versus LA.

As indicated on the map below, it is clear that there is minimal available land for development, causing the price of land to catapult in the face of ever-increasing demand (more to come on that later). With the costs of land skyrocketing in tandem with the price of building materials, construction fees and development charges, home prices will inevitably increase.

2/ IMMIGRATION:

The GTA population has been growing at a clip of over 100,000 per year. It’s forecasted that by 2030, the GTA’s population will exceed eight million people and will soon surge to over 10 million by 2045. It’s fair to say that Toronto is well on its way to becoming a Mega City.

In the short term over the next three years, the Government of Canada has stated its intent to permit 1.2 million immigrants into the country by 2024. Given that Toronto is one of the most multicultural cities and one of the most desirable cities to live in, it should be no surprise that 50% of all immigrants who come to Canada settle in Toronto. Toronto could see a population increase of over 600,000 in just the next three years alone.

3/ THE MILLENNIAL FACTOR:

Millennials are the segment of the population born between 1981 and 1996. One-third or close to 10 million Canadians are Millennials, and over 3.5 million millennials call Ontario home. This generation will have a heavy impact on the Toronto Real Estate Market.

In a statistic put out by NAR, the National Association of Realtors, it is estimated that the average age for a first-time homebuyer is 35 years old. Here in Ontario, the Toronto Regional Real Estate Board projects that there will be 700,000 first-time Millennial home buyers over the next decade. And most surveys of millennials indicate that they have a very favourable view of real estate and homeownership.

Look to millennials to become a massive driver of real estate demand for years to come. As prices continue to increase, expect generational wealth to be passed down from their parents, helping with down payments and property acquisitions.

4/ SUPPLY:

Various sources estimate that the GTA will need anywhere from 50,000 to 70,000 new units per year to keep with demand. According to CMHC, the GTA delivers between 33,000 to 36,000 new units annually. These numbers are far below the thresholds needed to service current and future demand. To provide further context, many who fear a real estate bubble based anecdotally and solely on the number of cranes in the sky need to be aware that the average condo building is only 400 units, just a drop in the bucket compared to what’s required.

Government development restrictions are hampering supply. It can take anywhere from 5-7 years to take a project from inception to completion. In conjunction with land constraints caused by the Green Belt, this time lag has and will continue to put extreme pressure on the building industry to keep up with demand.

SUMMARY:

As expensive as Toronto is, it’s about to get a lot more expensive. Future demand will be driven internally (by millennials) and externally (by immigration & international investment). Also, supply will continue to be constrained by the Green Belt and our inability to physically produce enough housing to keep up with demand. It’s Basic Economics 101. Prices are determined where demand and supply meet, and that meeting place will continue to grow over the short and long term!

This article is written by Ralph Fox, Broker of Record and Managing Partner here at Fox Marin Associates. Ralph is a Torontonian native who recognized from an early age that the most successful people in life apply long-term thinking to their investments, relationships, and life goals. It’s this philosophy, along with his lifelong entrepreneurial drive and exceptional business instincts that help to establish Ralph as a top agent in the real estate market in downtown Toronto.