Has The Toronto Bubble Finally, Popped?

Unless you have been living under a rock, you more than likely have heard talks of doom and gloom regarding the possibility of an economic recession. Discussions of a recession usually cause hearts to race. There is an automatic association of the word “recession” with connotations of fear and negativity. However, recession is just a normal part of an economic cycle. When the next economic downturn happens (and it eventually will), what if any effect will it have it have on the Toronto real estate market?

The most commonly accepted definition of a recession is: when an economy experiences two consecutive quarters of negative economic growth, measured by a decline in Gross Domestic Product (GDP).

With this in mind, one begs the question, is a global recession in the works? How will it affect Canada? What impact will this have on the Toronto real estate market?

Effective September 1st, the Trump administration imposed a 15% trade tariff on all Chinese goods. This applies to approximately $112 billion of assets. In response, the Chinese retaliated by further imposing tariffs to be implemented by both countries later in 2019. Following these events, uncertainty around trade and the potential of inflation has given rise to precipitous talks of recession amongst businesses and consumers alike. This alone can ultimately lead to a self-fulfilling prophecy.

[image via wired.com]

[image via wired.com]

CIBC Economist, Benjamin Tal, characterizes Trump’s approach to China by noting, “the more we think about it, the more we realize this trade dispute is going to be with us for a long time. The fog is not going to clear because Trump doesn’t want it to clear.” The problem here is that Mr. Trump has set off a number of conditions that are beginning to spiral out of control.

While Canada does not participate in a significant amount of trade with China, the U.S. remains our largest and most important trading partner. If the world’s two biggest economies get embroiled in an all-out trade war and a global slowdown ensues, Canada’s economy will ultimately see the impact.

The climate of uncertainty pursued by the Trump administration has spooked the financial markets and this results in an inverted yield curve.

In short, the yield curve is a way to measure the gap between interest rates and the return investors get from investing in shorter or longer-term debt. This gauge is considered to be the “canary in the coal mine” measure to predict if an economy is heading into a recession.

Typically, banks payout higher interest for longer periods of time (because a dollar today is worth more than a dollar tomorrow). A yield curve goes flat when the premium for longer-term bonds drops to zero. So, if the spread turns negative (meaning shorter-term yields are higher than longer maturity debt), the curve is inverted.

Imagine this happening in an everyday scenario. Picture refinancing your home and being able to lock in a cheaper rate for five years versus the variable. That is exactly what is happening here in Canada.

A yield curve inversion precedes both the first tech bubble and the 2008 market crash. Historically, the U.S. yield curve has shown inversion around 12-18 months prior to each recession that occurred in the past 50 years. As a predictor, the inverted curve has only been wrong once over the last 50 years. If this, paired with increasingly low interest rates that have almost bottomed out, is not a harbinger of global economic challenges to come, I’m not sure what is.

There is a recent study by UBS surveying 360 family offices around the world, with an average of $1B under asset management. The most striking piece of the survey reports that more than half of those family offices anticipate an economic downturn. In fact, 91% believe that the U.S. and China trade war will have “major economic implications in 2020“.

Harvard professor, former Secretary of Treasury under Bill Clinton, and former economist to President Obama, Larry Summers shares “I haven’t been this alarmed since the financial crisis”. Despite the stock market’s resilience so far, Summers emphasizes a weakening U.S. manufacturing sector, ongoing trade tensions with China and slowing global economic growth as the key challenges.

UNCTAD, the UN’s Trade and Development body explains that 2019 will endure the weakest expansion in a decade. Because of this, there is a risk of the slowdown turning into outright contraction next year.

They continue to explain that global growth will fall from 3% in 2018 to 2.3% this year. This is its weakest since the 1.7% contraction in 2009, according to the report. Several big emerging countries were already in recession and some advanced economies, including Germany and the UK, were dangerously close to one.

“The slowdown in growth in all the major developed economies, including the U.S., confirms that relying on easy monetary policy and asset price rises to stimulate demand produces, at best, ephemeral growth, while tax cuts for corporations and wealthy individuals fail to trigger productive investment.”

Warren Buffett, the most successful investor of all time and the man who once wrote “be greedy while people are fearful and fearful while people are greedy” is currently sitting on the sidelines, waiting for the next recession. Buffett’s company Berkshire Hathaway is currently holding half of its assets – $122 billion in cash and cash equivalents. Does Warren (and Warren is never wrong) know something we don’t?

After reaching an unemployment rate low of 5.4% earlier this year, unemployment has been creeping up to 5.7%. While Canada is still creating jobs, it is not the number of jobs that fundamentally matter, it is the quality. CIBC’s index looks at the quality of employment in Canada. It illustrates a 1.4% decline during a 12-month period ending May 2019.

Economist Benjamin Tal points out, even though full-time employment increased faster than part-time (accounting for 81% of all jobs created), it is those quality full-time jobs that have been declining.

“The number of low-paying, full-time jobs rose very strongly relative to mid-paying jobs, with the weakest performance seen among high-paying industries. The worsening composition of the compensation sub-index reflects strong growth rates in relatively low-paying sectors such as food services, accommodation, personal services, administration and personal care, as well as non-store retailing. Regardless of how you measure it: by occupation, by industry and more directly by income, the overall quality of employment in Canada is on the decline.”

In addition to concerns over Canada’s labour market, even more concerning is the complete flatlining of consumer spending. The major economic engine that continues to propel economic growth over the last decade is consumer spending. With confidence flatlined in Canada, combined with a sluggish labour market, our is economy more vulnerable to the global slowdown.

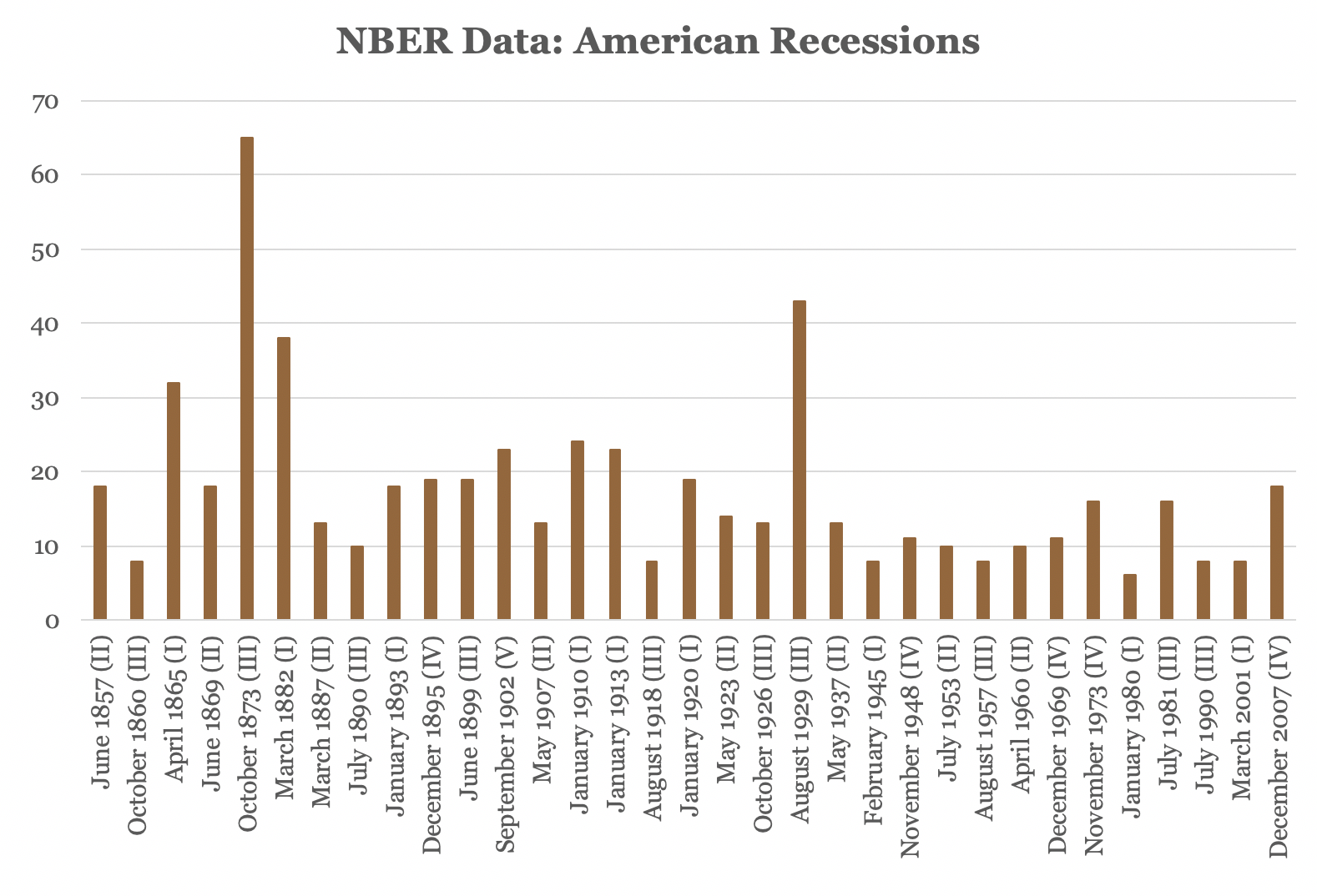

According to the National Bureau of Economic Research, the average length of a growing economy is 38.7 months or 3.2 years. The U.S. economy is now in its 11th year of expansion. So, to say that we are overdue is an understatement. The good news is that historically, recessions do not last long, with the average recession spanning 18 months. It is also important to keep in mind that the average recession comes and goes fairly quickly. So, with the potential of an imminent recession being trade-related, it should not be nearly as deep or as long as the great recession or the subprime crisis of 2008. Below is data on when these events have historically happened and how long they lasted:

[Source: National Bureau of Economic Research (NBER)]

[Source: National Bureau of Economic Research (NBER)]

One would think in this climate of geopolitical and economic uncertainty, combined with Canada’s slowing labour market and consumer confidence, that the Toronto real estate market would be negatively affected. However, the market has in fact been heating up spurred on by low interest rates and chronic supply issues.

The Toronto Real Estate Board (TREB), illustrates that sales are up on a year-over-year basis for all major market segments. Annual rates of sales growth are strongest for low-rise homes in the GTA over the month of August. In the 416-area code, detached homes are up 21%, semi-detaches up 12% and condos up 4% year-over-year. The average days on the market being down from 27 to 25 days.

Global events have put downward pressure on interest rates. This caused the Toronto real estate market to rebound after the implantation of the B20 stress test earlier this year. The Bank of Canada is trying to hold off from reducing interest rates any further to attempt to keep the housing market in cities like Toronto and Vancouver in check. Many economists are calling for the BOC to reduce its rates. However, despite the Bank of Canada’s reluctance, a force of hand may result due to monetary easing by other governments around the world as a response to a pending global economic slowdown.

Short-term, mired by chronic supply and inventory shortages, look for the Toronto real estate market to heat up this fall. As the gap between the prices for condos and low-rise homes becomes the tightest it has been historically. Look for low-rise freeholds (semi-detached and detached) to lead the charge in price appreciation, as many condo owners will look to leverage their equity and upgrade from a condo into a freehold while money is cheap.

Let’s take a look. The last real recession was the global financial crisis in 2007-2008. There was a severe meltdown amongst the worldwide banking systems. This was considered by most economists only to have been surpassed by the Great Depression in terms of severity. This meltdown saw real estate prices in major markets around the world get decimated. Many are predicting a recession on the horizon. However, none are predicting it to be as nasty, deep or widespread as the meltdown of the 2008 subprime crisis.

Below is a graph showing price performance of 3 market segments in downtown Toronto (East: C08/ E01, Central: CO1 and West: W01) from 2005- 2012.

The 2008 subprime meltdown marked that entire collapse of the global financial system. By using the performance of the Toronto real estate market as a stress test, you will see how resilient the Toronto market is in terms of performance. The global meltdown was literally just a blip on the radar for Toronto real estate, before prices take off again. This was all at a time when global banks were going bankrupt, the mass media was predicting financial Armageddon and life-time personal savings of individuals were obliterated almost overnight. If you don’t believe me, I have the data to prove it!

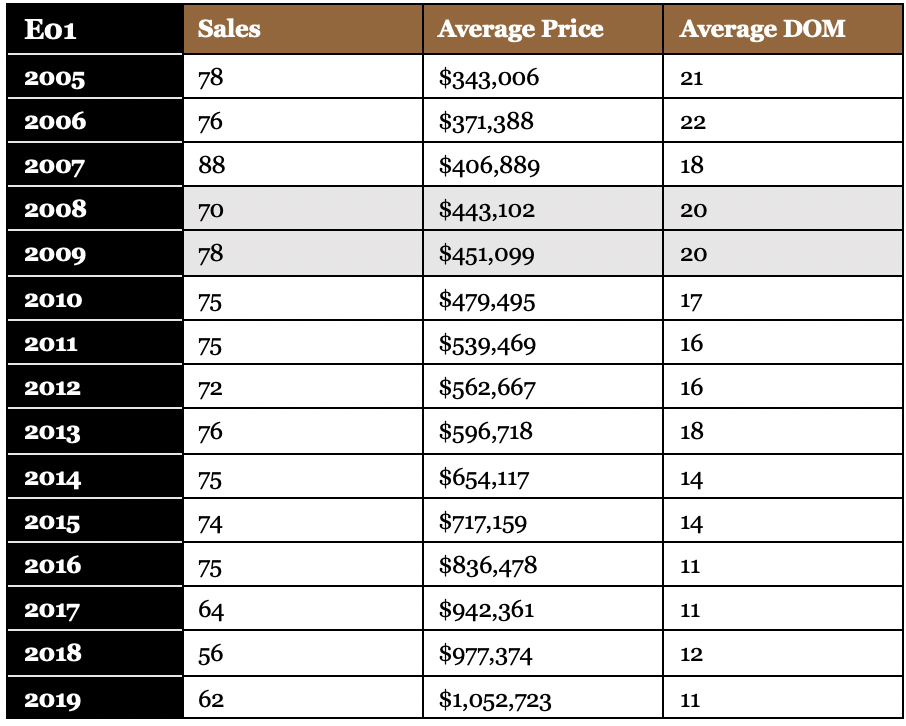

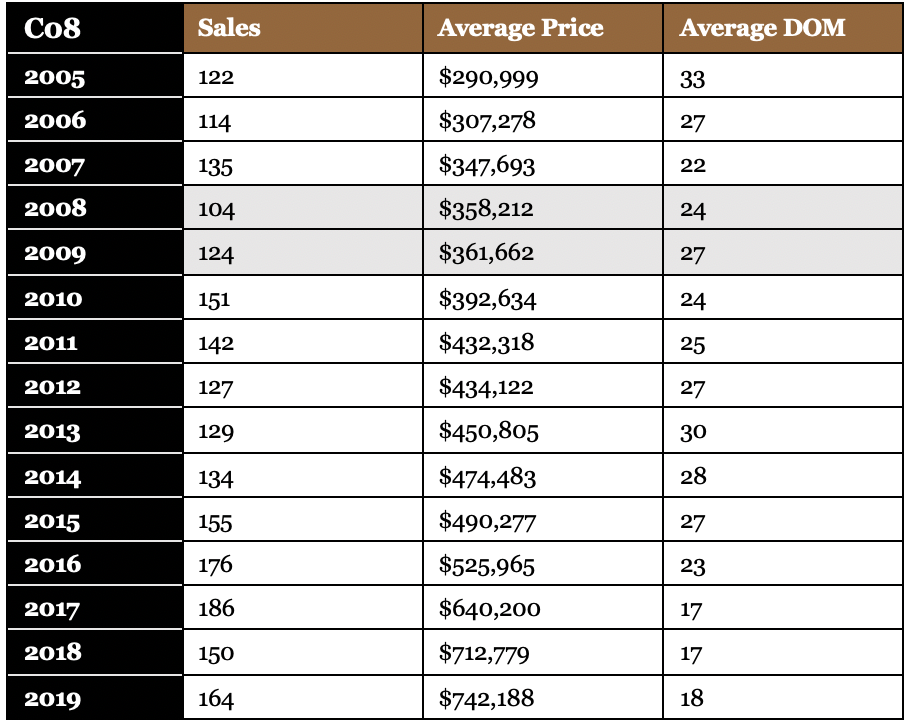

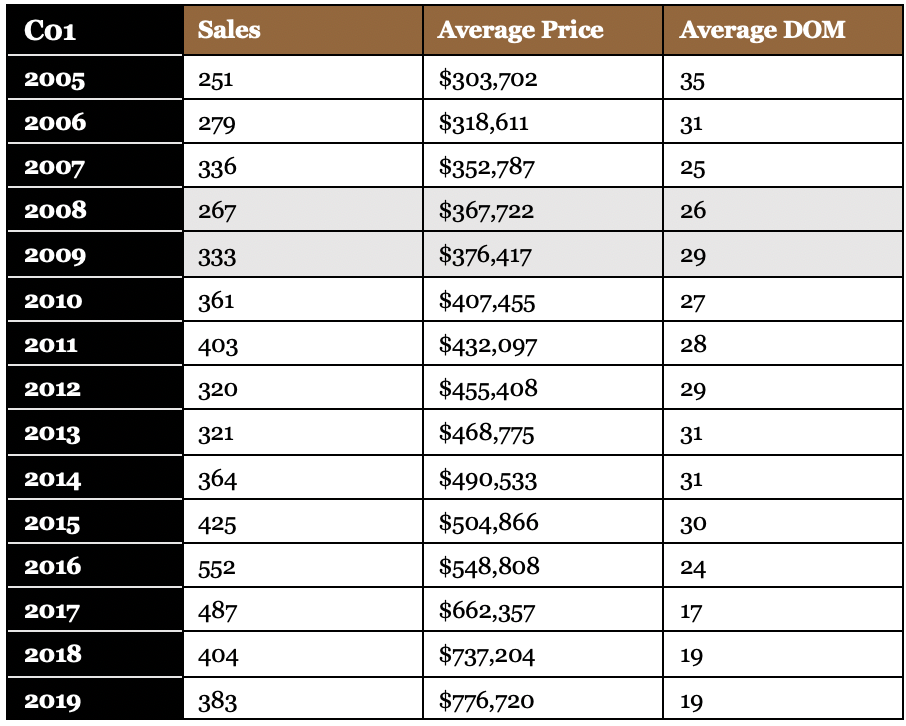

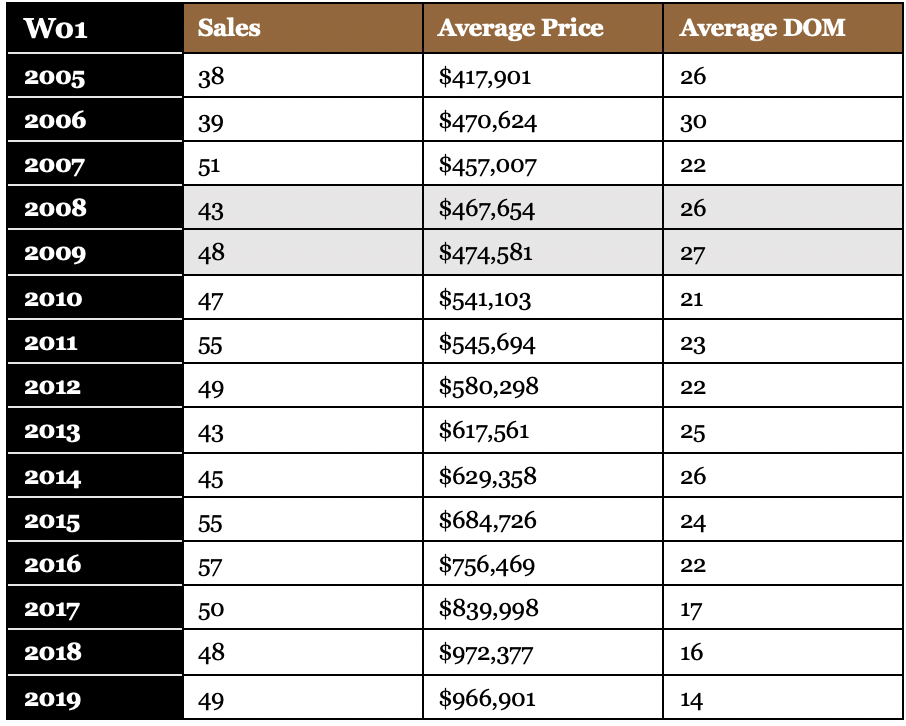

Below are the charts outlining historical price performance over four market segments in downtown Toronto before, during and after the subprime from 2015-2019:

EAST 01: LESLIEVILLE, UPPER BEACH

EAST C08: EAST OF YONGE TO DVP

CENTRAL C01: WEST OF YONGE TO DUFFERIN

WEST W01: RONCESVALLES / WALLACE EMERSON

Fact is, the underlying fundamentals driving the Toronto real estate market are strong. Possibly even stronger today than 11 years ago. The 20-year historical performance of the Toronto market is not a statistical fluke. It is spurned by strong immigration and lack of supply due to decades of incompetent government policy. This is not going to change anytime soon if ever. If you are looking for continued long-term appreciation or capital preservation during an economic downturn, you will find no better safe harbour than the Toronto real estate market.

—

This article is written by Ralph Fox, Broker of Record and Managing Partner here at Fox Marin Associates. Ralph is a Torontonian native who recognized from an early age that the most successful people in life apply long-term thinking to their investments, relationships, and life goals. It’s this philosophy, along with his lifelong entrepreneurial drive and exceptional business instincts that help to establish Ralph as a top agent in the real estate market in downtown Toronto.