Has The Toronto Bubble Finally, Popped?

On May 18th, the CMHC came out with a dire end of days prediction proclaiming, amid a widening recession and global pandemic that home prices would drop by as much as a whopping 18%!! The real estate armageddon that many had prophesized for decades was finally upon us. Everyone loves a good doom and gloom real estate story, and the mass media picked up on it went into a frenzy. It was time for everyone to head for the hills. Well, guess what, surprise, the bureaucrats, pundits, and doomsayers were wrong yet again, dead wrong. Flash forward to August 2020, sales reported by the Toronto Real Estate Board were up 40% with days on the market down from 25 days (last August) to a blistering 17 days! Last month, detached and semi-detached houses were up +21% year over year, with condo apartments showing a stable +8.7% appreciation rate. Where did the CMHC, analysts, and media go so wrong? What does this mean for both the short-term and long-term future of the Toronto Real Estate market?

In the early months of 2020, leading up to the pandemic, we saw incredibly tight inventory conditions in the face of intense demand, creating a highly competitive market where real estate prices surged at a torrid month-over-month pace. It looked and felt much like the market conditions of Spring 2017 before the Wynne Government’s nonsensical legislation that led to a very short-lived market slowdown. However, things shifted dramatically in April and May, with the Province of Ontario under full lockdown, the Toronto market took a pause. Transactions dropped by as much as 60- 70%, but prices held relatively firm. As the activity began to pick up in June, prices rose once again when things started to open up.

By June, it became clear that those most affected by the pandemic’s economic effects were the lower wage earners. When the dust had settled, it turned out that a vast majority of homeowners did not see their incomes affected. In many cases, for higher-income earners, their financial position strengthened! Emboldened by low incredibly low-interest rates, mid to upper-income earners became incentivized to move into action. As the Province began to emerge from lockdown, buyers on the sidelines jumped back in with both feet.

THE GREAT TIME OUT:

While the Province was in a full lockdown in April and May, it provided much downtime for Torontonian’s to rethink: how they lived, worked and played. One of the first ways people could express their need to implement change in their current living circumstances was through their real estate choices. The underlying theme being the need and desire for more; indoor, outdoor and home office space. Some homeowners cashed out and moved to the suburbs or the country to search for more space, while others looked to upgrade their living environment while still remaining in the city. Investors have also been active, due to the cheap cost of credit: a recent study put out by CIBC noted that 25% of homeowners were considering acquiring a second property.

Over the summer, the net result was that demand for all classes of Toronto Real estate remained very strong in the face of highly restricted inventory levels, causing prices to run-up. We at Fox Marin have always maintained that the lack of affordability in Toronto results from insufficient supply caused by crippling government policy and taxation. It is inaccurate and almost borderline xenophobic to solely blame the lack of affordability on “foreigners” and foreign investment. It is interesting to note that the pricing run that has taken place last summer was at a time with foreign investment levels at record lows with a foreign investment tax firmly in place. This is a strong indication that the issue of affordability in Toronto is far more complicated than pointing fingers at “foreigners.”

THE PERFECT STORM:

However, the Toronto rental market has been another story, and for the first time in recent memory, it has softened. As a result of the pandemic, the Canadians who have been most hurt financially are low-income earners and renters. Further exacerbating the situation is that immigration and international students moving to Toronto has temporarily come to a standstill. In the face of slowing demand, Air BnB rentals flooding the market have caused oversupply with more than 5,000 units for rent currently in the downtown core.

Does this mean Rental Armageddon? In a recent interview with Sean Hillebrand, Senior Vice President of Urbanation on BNN, Hilebrand points out that before the pandemic, the vacancy rate in Toronto was 1%, and today it stands at 1.8%, which is still relatively low compared to most major cities, with New York, for example, sitting at 3.8%. According to Hilebrand “there’s an understanding that immigration will rebound over the longer term, the job market will recover, and rental demand will ultimately continue to exceed the amount of new supply that’s being delivered”. Undeterred but the recent softening of the rental market, purpose-built rental developers continue to double down, putting their money where their mouth is as more than 3,000 new apartments were proposed in the past three months, a 45% increase the same period in 2019.

THIS FALL WILL BE A BUMPY RIDE:

The overall velocity and price appreciation due to pent up demand that we saw in the summer are unsustainable at its current pace, and we expect the market to slow down and level out as we head into Fall 2020. We are forecasting to see the demand for low rise freeholds to continue to remain stable, with price appreciation beginning to level off. The condo resale market and rental markets will continue to soften in tandem facing stronger headwinds with low immigration numbers and increased supply.

One of the biggest mitigating factors surrounding the Fall Market is the uncertainty surrounding the second wave of COVID, the US elections and US political instability. This will have a short term dampening effect on the Toronto Real Estate Market, with many people taking Dr. Fauci’s advice for “everyone to hunker down for the winter”. Entering into the fall as the market faces softer demand, pandemic concerns, and geopolitical instability to the south; overall growth will be moderate, with condos and rentals sliding into negative territory short term, which in turn will begin to rebound by mid-2021.

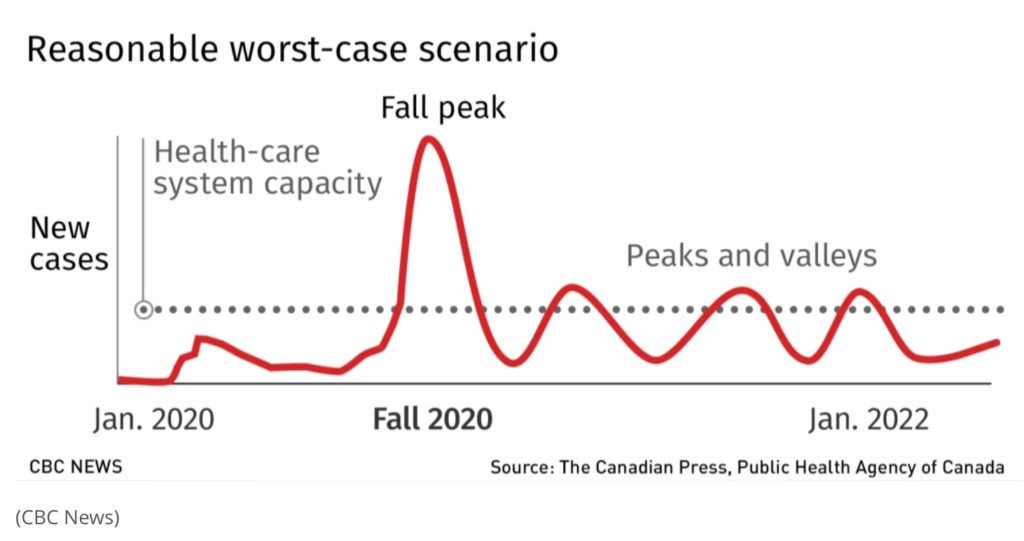

Below one of the most recent models put out by Health Canada predicting the upcoming effects of COVDID-19. There are many projections of a vaccine that will be ready by early 2021; as the pandemic begins to run its course, we expect the real estate market to respond accordingly in the face of government spending, low-interest rates and substantial income growth:

BRIGHT LIGHTS, BIG CITY?

There has been much talk lately about the death of large cities based on the argument that many people have realized that they can now work remotely and that, in turn, cities will be drained by an exodus of residents looking for greener, more extensive and less expensive pastures in the countryside. Some have predicted that this exodus will drain and eventually lead to the slow decay of megacities like Toronto and New York.

We would argue otherwise. For thousands of years since the early days of our existence, humans have always chosen to live and congregate in large groups and communities. Through famine, pestilence, pandemics and wars, cities like London, Paris, Rome, Jerusalem and Beijing, have not just survived, they have adopted, grown and thrived throughout the centuries, being the heartbeat for creativity and innovation. Humans, by nature, are social animals and need interaction, and collaboration makes up the essence of who we are in our DNA. It is not an accident that 1.7 billion people —23 percent of the world’s population live in a city with more than one million inhabitants.

In an open editorial, Jerry Seinfeld wrote in the New York Times a piece called “So you think New York is Dead? (It’s Not). Seinfeld went on to write

“Energy, attitude and personality cannot be “remoted” through even the best fibre optic lines. That’s the whole reason many of us moved to New York in the first place. Do you ever wonder why Silicon Valley even exists? I have always wondered why do these people all live and work in that location? They have all this insane technology; why don’t they all just spread out wherever they want to connect with their devices? Because it doesn’t work, that’s why. Real, live, inspiring human energy exists when we coagulate together in crazy places like New York City.”

In May, while almost all of western society was under some lockdown global commercial real estate behemoth, Jones Lang Lassalle commercial undertook a survey across North America, Europe and Asia. The survey results illustrate that office workers have a strong affinity to working in the workplace, and once able, they would prefer to go back to work in the office but with greater flexibility, allowing them to work from home several days a week. Based on the survey results, JLL projects that post-pandemic office use in the corporate world would remain at the same levels before March. However, what would change is how the spaces are used and maximized, emphasizing learning and development, creativity, and collaboration.

In this current climate, Amazon is doubling down on its commercial real estate office holdings, recently announcing that it will invest more than $1.4 billion in the new offices in Manhattan, Phoenix, San Diego, Denver, Detroit and Dallas.

When 9/11 happened, many people swore that they would never fly or go into a tall building again. That didn’t last long, as people tend to have short memories, as they always have a tendency to always choose to resume back to their lives as soon as possible. In the grand scheme of things relative to the history of our existence on this planet, the COVID pandemic will barely be a blip on the radar, and in a few years, our major cities will be filled with the hustle and bustle, and office buildings will be back in full use.

THE BOTTOM LINE:

Many major leading cities like Toronto will overcome the short term challenges presented by this recent pandemic and continue to innovate, adapt and grow. A handful of cities like Toronto will emerge from this pandemic in an even stronger position than before March. In a recent study of Hong Kong residents looking to flee china, Canada was their number one choice outside of Asia, with the US ranking dead last. Coming out of a time of turmoil and political stability; welcoming immigration policies and universal healthcare will be the top of everyone’s list. If you think Toronto was rising star amongst global cities before COVID, when the fog of this pandemic clears (and it will), the international interest and investment in our city will be at levels that we have never imagined possible. To anyone contemplating the long-term future landscape of Toronto real estate, we say that even though the next few months maybe a bit of a rough ride, with regards to our fair cities’ long-term prospects, you ain’t seen nothing yet…the best has yet come.