Has The Toronto Bubble Finally, Popped?

As we enter 2025, the Toronto real estate market is already showing signs of complexity, resilience, and shifting dynamics. The latest data from January provides us with a fresh look at trends across asset types, market conditions, and buyer sentiment. With economic uncertainty, global challenges, and evolving government policies, the question on everyone’s mind is: Where are we heading next?

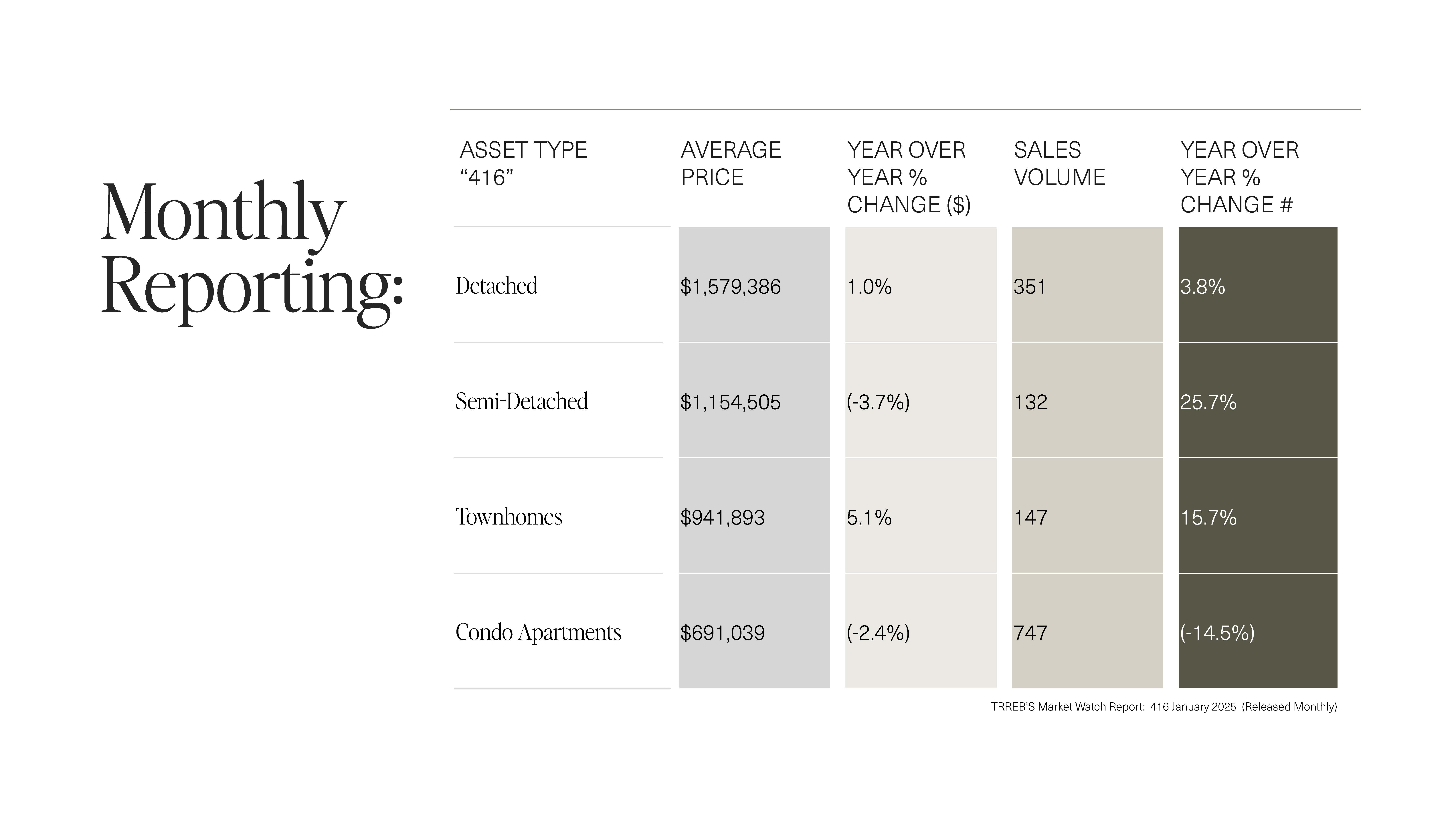

Toronto’s 416 region is witnessing notable shifts across detached, semi-detached, townhomes, and condo apartments. Let’s break down what the latest stats reveal:

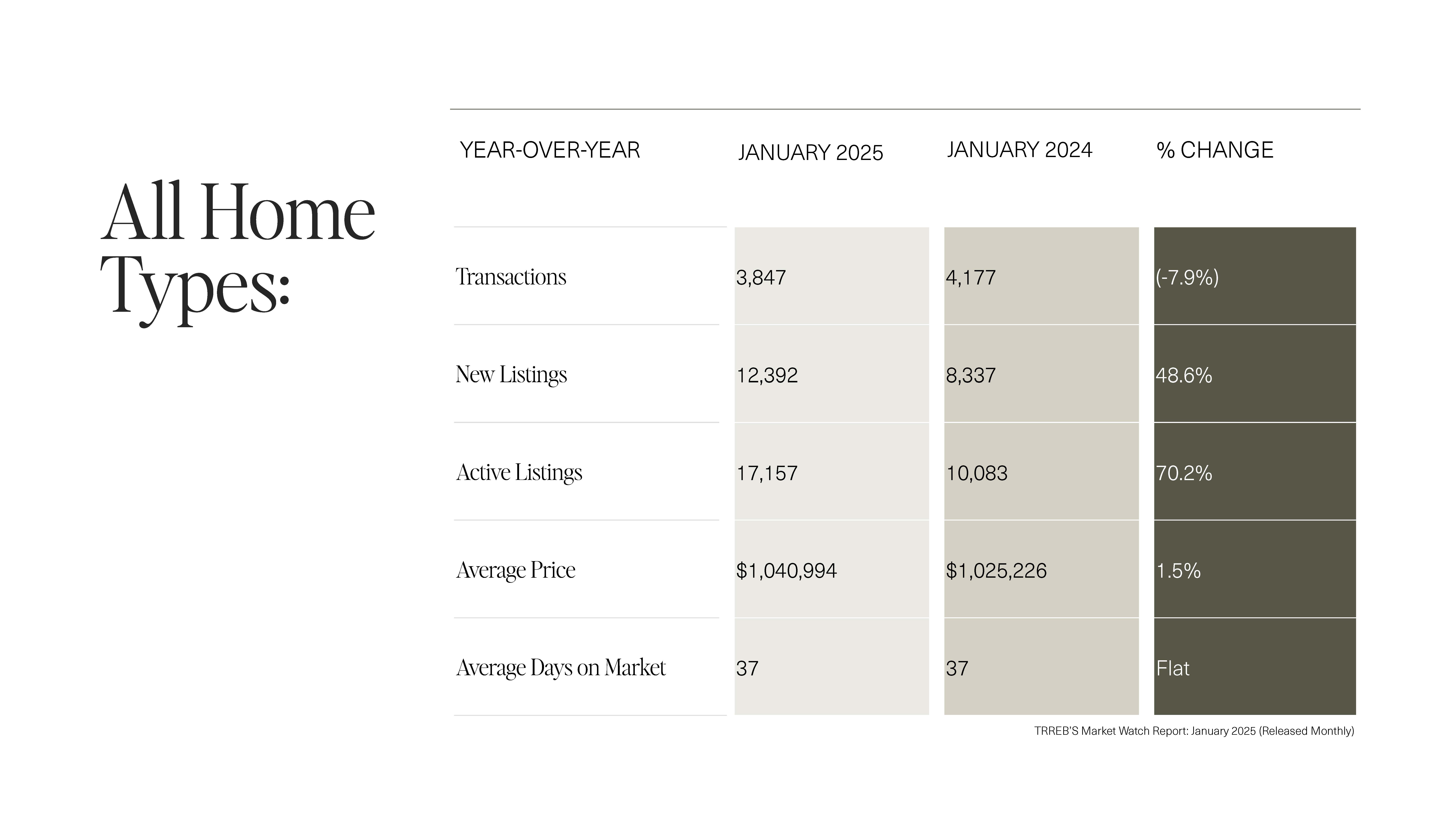

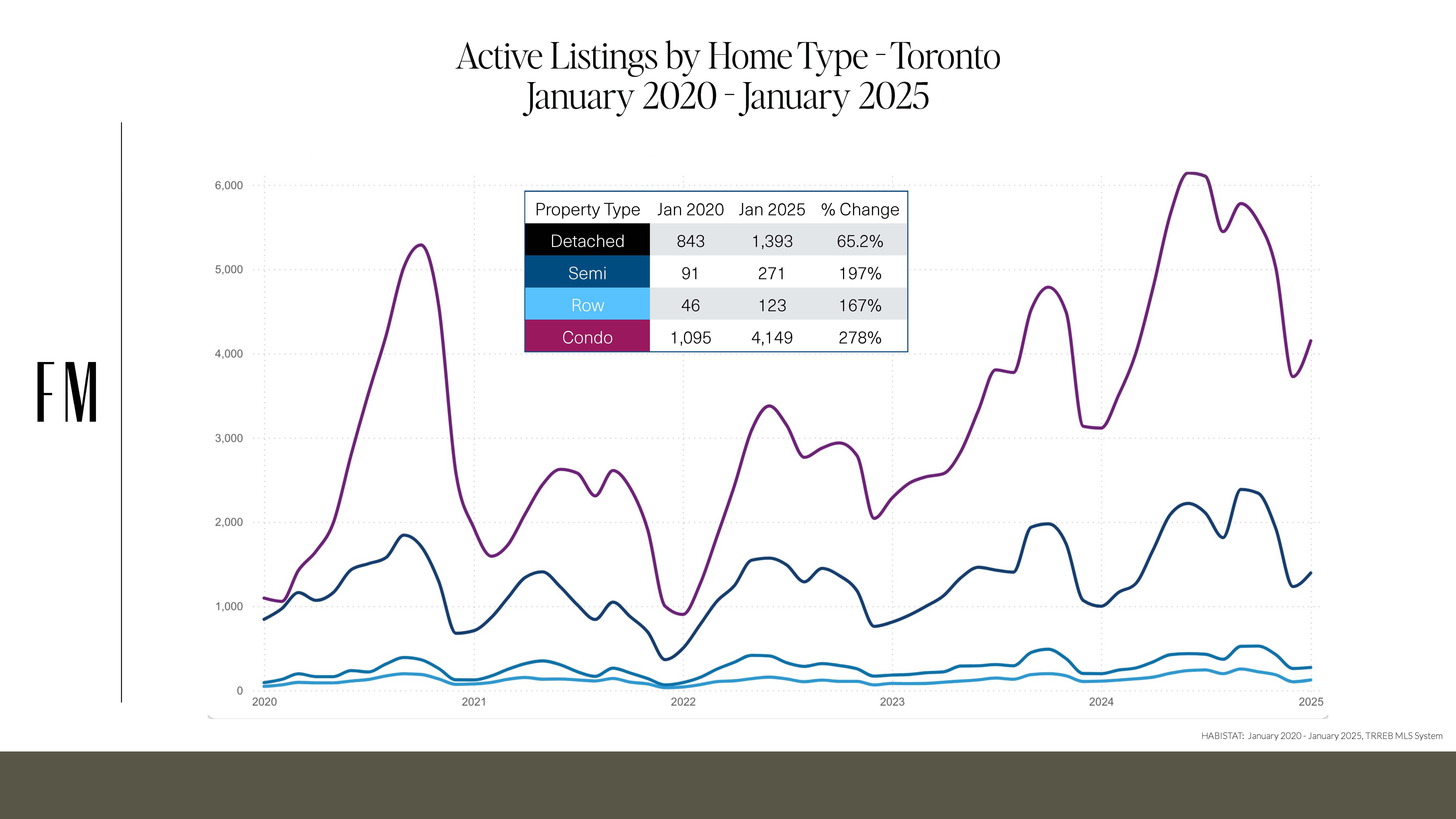

Looking at the bigger picture, the entire market, including all home types, saw a 7.9% decline in total transactions, while new listings surged by a massive 48.6%. This influx of inventory, combined with slowing transactions, is increasing market competition among sellers.

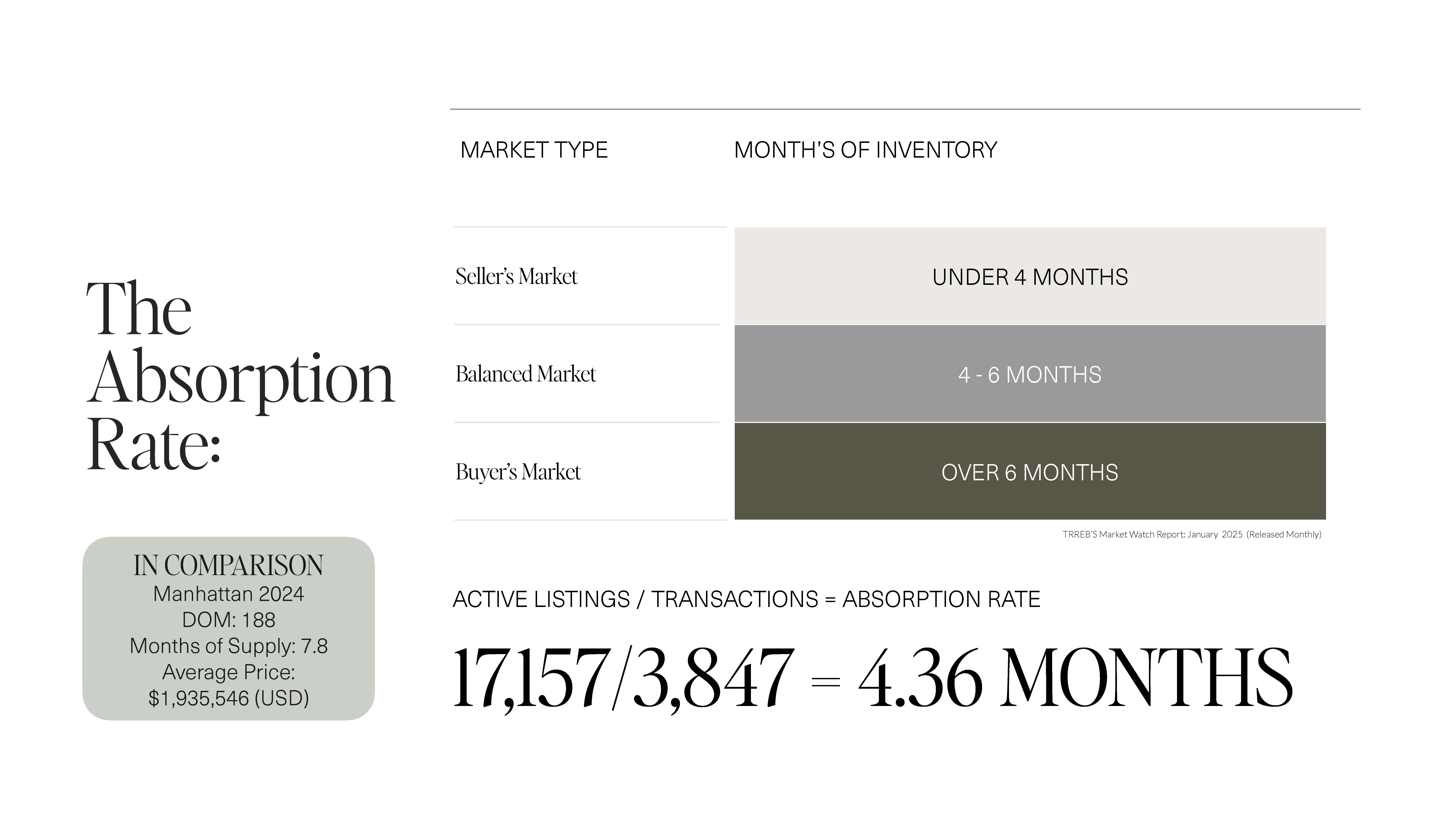

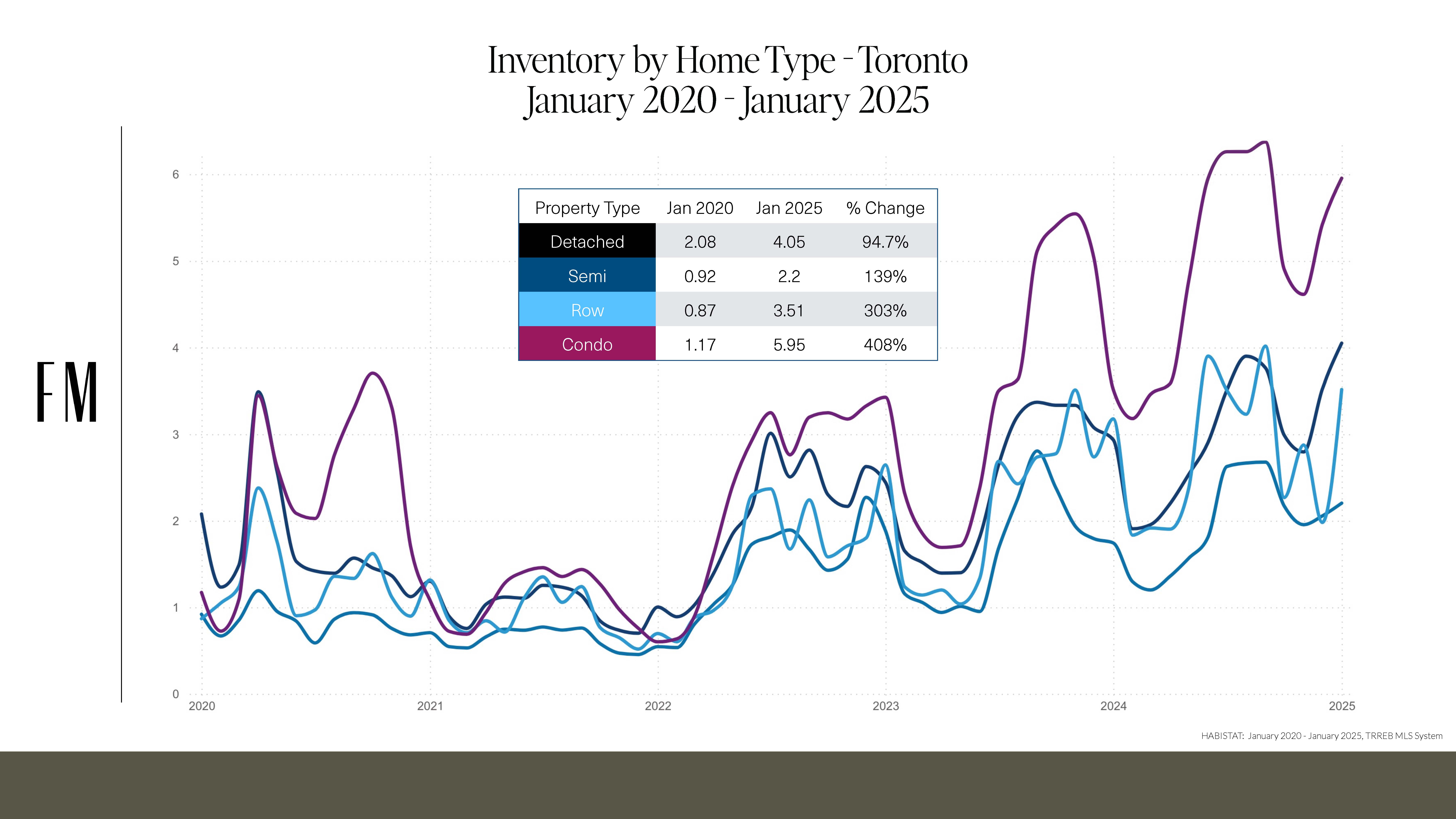

The absorption rate, calculated as active listings divided by monthly transactions, is a key metric to gauge market health. January 2025 reports an absorption rate of 4.36 months, positioning Toronto in a balanced market (typically 4-6months of inventory). However, the reality is more nuanced:

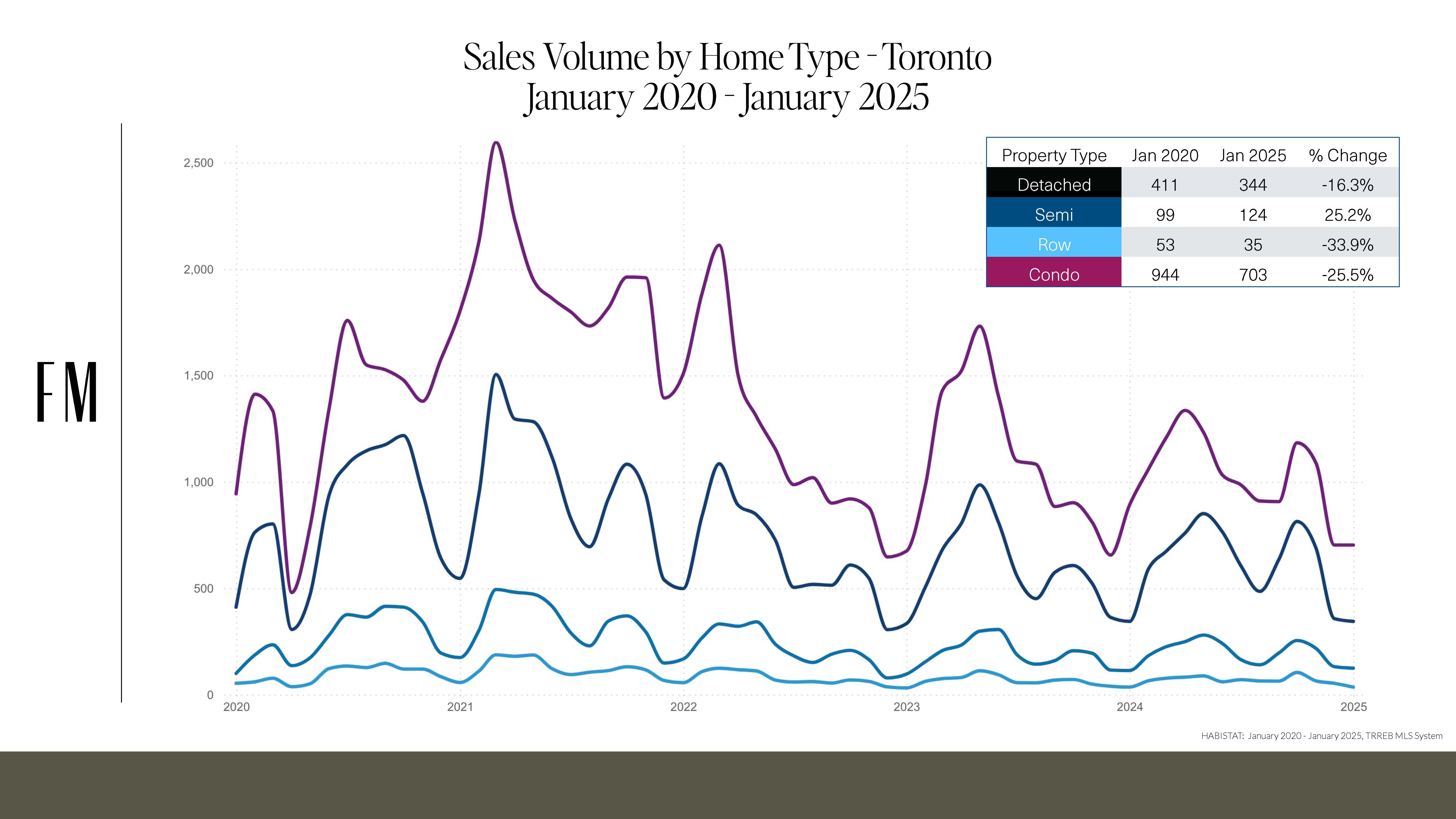

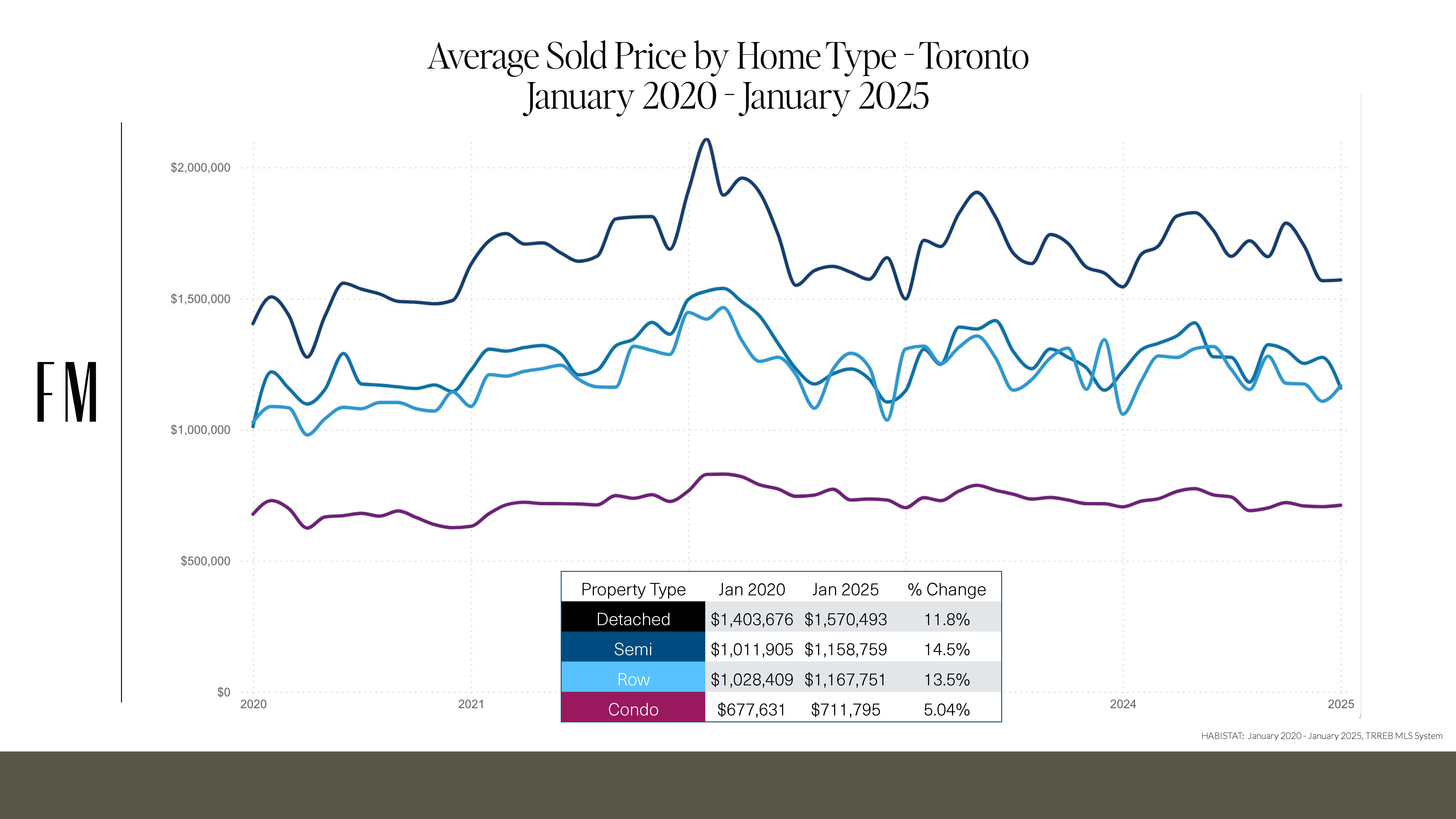

Comparing January 2025 to January 2020 (pre-pandemic) highlights a fascinating transformation:

One of the most compelling trends in early 2025 is increasing demand for semi-detached homes. Several factors contributed to this surge:

If there’s one part of Toronto’s market struggling the most, it’s the condo segment. The surge in active listings and a decline in sales volume tell a straightforward story:

While early 2025 data reveals a mixed market, we anticipate the following trends in the months ahead:

For those looking to buy or sell, understanding these micro-market shifts is critical. The Toronto real estate landscape is evolving, and strategy matters more than ever. If you’re thinking about making a move in 2025, reach out to our team for a tailored approach based on the latest market insights and our tenured experience in this high-velocity marketplace!

Contact us (We’re Nice).

Fox Marin has earned its reputation as Toronto’s premier downtown luxury real estate team, backed by over *$580 million in sales, more than 1,000 successful transactions, and over 500+ glowing 5-star Google Reviews. Discover the advantage of working with a proven team with a track record for winning results.

(*Source: Jan. 1, 2018 – Sept 1, 2025, RE Stats Inc. & Exclusive)

—

Kori Marin is a Toronto Broker & Managing Partner at Fox Marin Associates. For high-energy real estate aficionado Kori Marin, a well-lived life is achieved by maintaining an “all-in” attitude that realizes every last ounce of one’s full potential. This mindset has driven successful results in every aspect of her life – from her corporate sales and account management experience to her international travels to her years of fitness training and leadership – and is the hallmark of the exceptional work that she does on behalf of her clients in the residential real estate sector in downtown Toronto.