Has The Toronto Bubble Finally, Popped?

Should you rent or own? With each passing year, it seems that for many, the dream of home ownership continues to slip further and further away. And, that’s regardless of where you are in your career or life. For millennials, we are the first generation who are statistically living at home longer than any generation before us. We face various impediments in the path to homeownership. These hurdles include higher rents and home prices, tight inventory conditions, and student loan debt repayments, to name a few. For baby boomers, it was typical to leave the nest and purchase a home in your early 20’s. Today, the average age for first-time homebuyers in Toronto is currently 32-years-old.

Conversely, Toronto has the highest rental prices in Canada. So, when it comes to choosing to rent or buy in Toronto, you have to look closely at your finances. Start by weighing the pros and cons of each scenario, factoring both explicit costs and opportunity costs for a clear vision of the big picture.

And, if there is one thing we know for sure, the best day to buy is always yesterday. As prices climb, the money you have today will be worth less tomorrow, especially over the long-term.

So when it comes to homeownership, without question, the most challenging hurdle to overcome on the journey is having enough money for the down payment. And, this will be the most significant factor in your lease versus own equation.

But how do you critically measure if it makes more sense to rent or own in a high-velocity and competitive real estate market – especially relative to the average income which currently sits at around $82k in Ontario. We’re taking a deep dive into the various costs associated with each scenario to see if it is better to rent or own in Toronto. Both over the long- and short-term.

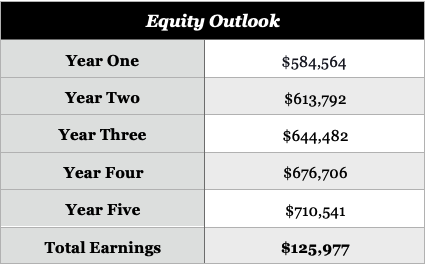

For learning purposes, let’s take the average cost of a condo in Toronto, as per TREB’s Q3-2019 Market Watch Report. This brings us to $584,564 (it’s okay if that number surprises you, you’re not alone!).

So, you’ve found your dream condo in this price range and the minimum down payment you can make on that condo is 5% on the first $500k, plus 10% on any remaining amount. That brings us to 5.72% of the purchase price or $33,456. That seems like a substantial number doesn’t it? And it is.

Now, let’s compare that to what it would cost to rent that same condo. Based on the Q3-2019 TREB Rental Market Report, it’s about $2,339 /month for Toronto Central.

After only a year and a half of renting, you’ll have paid more in rent than it costs to own that same condo! And really if you think about it, a year and a half is not that long at all. I’ve had goldfish that have lasted longer.

In Canada, there are two types of mortgages:

What’s the difference between the two?

Buyers who put less than 20% down on their home will have to pay a slight premium on their monthly instalments to their lender as “insurance”, in case they default on their mortgage.

But don’t let this premium deter you. Over the long term, you are still earning more money in appreciation versus waiting a few more years when resale prices are even higher. In fact, at the end of 2018, the condo market was leading the industry with an 11.4% increase year-over-year. And, we don’t expect these numbers to falter, even in the face of a potential economic recession. As more and more individuals get priced out of the freehold markets, expectations will change. Buyers will opt for a smaller space if it means they can get their foot into the homeownership door – both literally and figuratively.

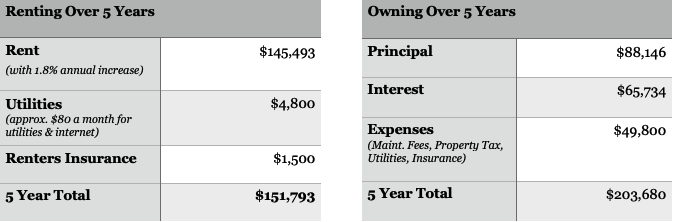

In order to calculate the comparative costs to either rent or own, let’s say you secure a five-year fixed rate mortgage at 2.49% over a 25-year amortization period. Your monthly mortgage payments will be $2,565 with the minimum down payment. This is compared to $2,339 per month in rent – that’s not a huge spread! Of course, you also incur utility bills, renter’s insurance, and as a homeowner, you’re looking at property taxes and maintenance fees in addition to.

So, while the monthly difference to rent vs own nets out to about $865 per month, ($2,530 to rent vs $3,395 to own), think of the marginal difference as a forced savings account that you will see again, versus giving to someone else so THEY can pay off their mortgage.

Now, real estate in any market is never a short-term play. Thinking long-term will allow you to make a more informed decision when measuring the pros and cons of owning. Let’s take a look at what the above figures would amount to over a five-year period.

Even though condos appreciated over 10% year-over-year at the end of 2018, conservatively and for the sake of projections, we’ll use the historical average in our charts, which is a 5% growth per year.

Okay, so you’ve spent an additional $52k in owning. BUT, let’s not forget about that glorious thing called EQUITY!

As you can see, in five years’ time, you’ll have earned $125,977 on your investment – and by doing no manual labour! This is in parallel to the $151,793 you would pay in rental costs for that same suite and all the while, have nothing to show for it.

After the five-year term, with your insurance premiums, your mortgage balance is $485,007 – less if you put 20% or more down. But the equity you’ve earned over five years means, if you were to sell that condo, you’d still make a profit. Let’s say you decide to upgrade your living situation and at the end of your five-year term, you sell your condo at its current market value of $710,541. After paying your mortgage balance, closing expenses and legal fees, you’re still walking away with $180,000!

Not to mention, because this was your principal residence, all profits earned are 100% tax free!

Now tell me, where else you can passively make that kind of money, legally and tax-free in that same time period? Remember, the difference between renting versus buying is that when you rent, you are renting space. When you buy, you are renting money.

In conclusion, renting might seem like the easier and more affordable choice right now. However, over the long-term, you are essentially robbing from yourself by not taking the leap into home ownership at the first opportunity. The biggest challenge will be putting together your down payment. If you commit to buying and make small sacrifices to save, you’ll be on your way in no time!

And remember, the best time to plant a tree was 20 years ago. The second best time in NOW!

If you’d like to talk about renting or owning and makes more sense for you, reach out to us today. We’ll be happy to chat! I’ll bring the coffee 😉

—

This article is written by Urban enthusiast and food/travel junkie, Jessica Elizabeth Spillas. As the firm’s multi-talented Business Development Manager and Sales Representative, she is able to pair her passionate approach to buying, selling and investing in Toronto Real Estate with her flair for design and digital marketing. With this in mind, Jessica delivers unparalleled service with every interaction and works hard to keep her clients and colleagues organized and working at top-notch efficiency.