Has The Toronto Bubble Finally, Popped?

As we close out 2024, it’s the perfect time to reflect on the trends, challenges, and opportunities that shaped the Toronto Real Estate market. The year was a rollercoaster ride filled with optimism, uncertainty, and notable shifts across home asset classes. Leveraging the most recent November data from the Toronto Regional Real Estate Board (TRREB), we’ll take a comprehensive look at the numbers and their implications for 2025.

The Tumultuous Year That Was

This year presented a series of starts and stops, leaving many buyers and sellers in a state of flux. Interest rate fluctuations, government instability, and affordability concerns dominated the conversation. For those navigating the market, the experience often felt like being in “real estate” therapy—both for clients and agents alike. Are we right?

Let’s break it down, beginning with detached homes and then moving through semi-detached homes and the elusive condos segment. To add some additional food for thought, we’ve included data on transaction volumes, pricing, and inventory levels across these three categories.

Transaction Trends

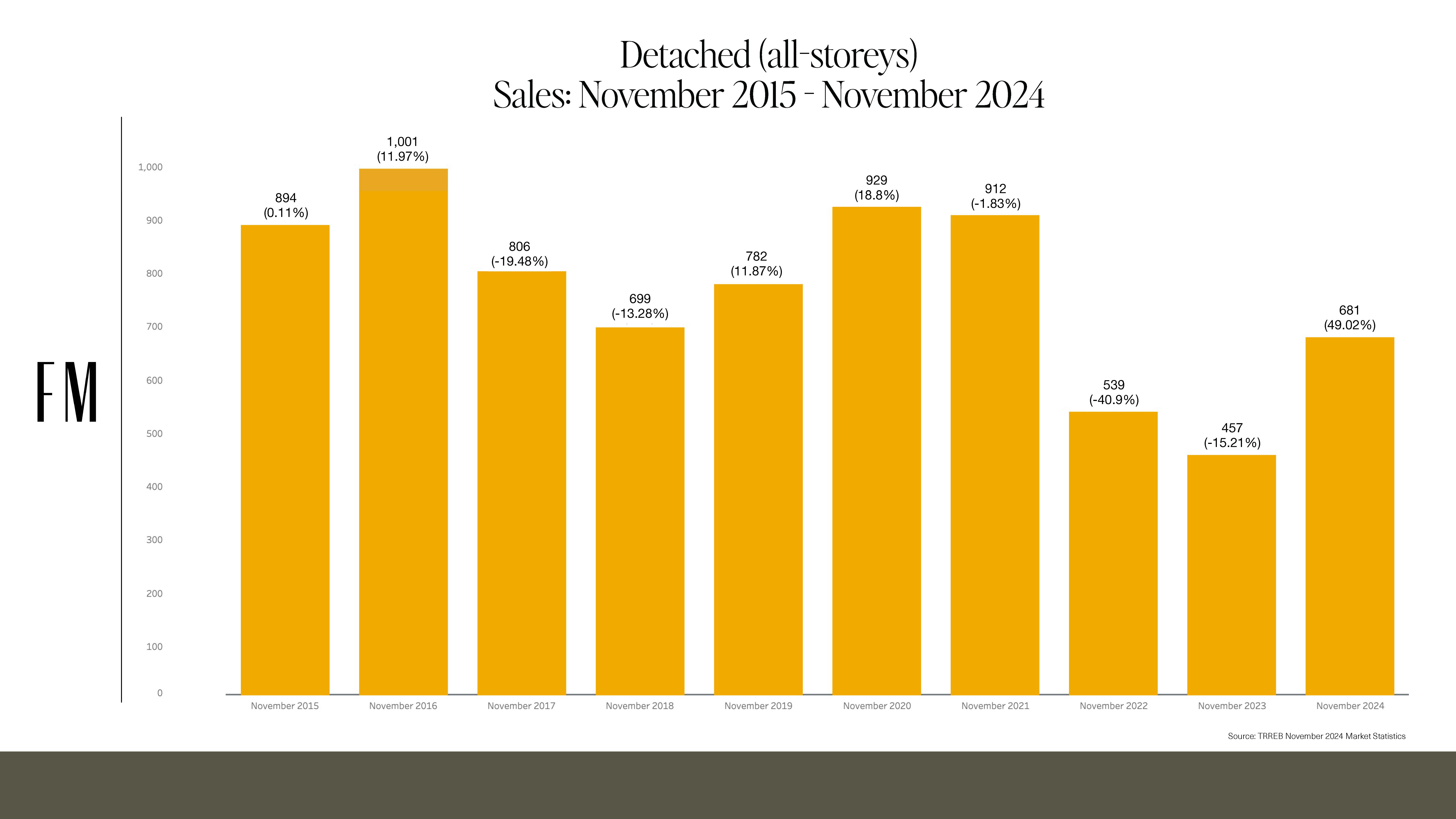

Detached homes remain Toronto’s highest price category, encompassing everything from starter bungalows to luxury estates in neighbourhoods like Rosedale and Forest Hill. In November 2024, we saw 681 detached sales in the 416 area, a 49% increase in volume compared to November 2023.

While this figure is an improvement, it’s worth noting that sales remain below historical highs, where November transactions often hovered around 1,000. Key factors influencing this dip include:

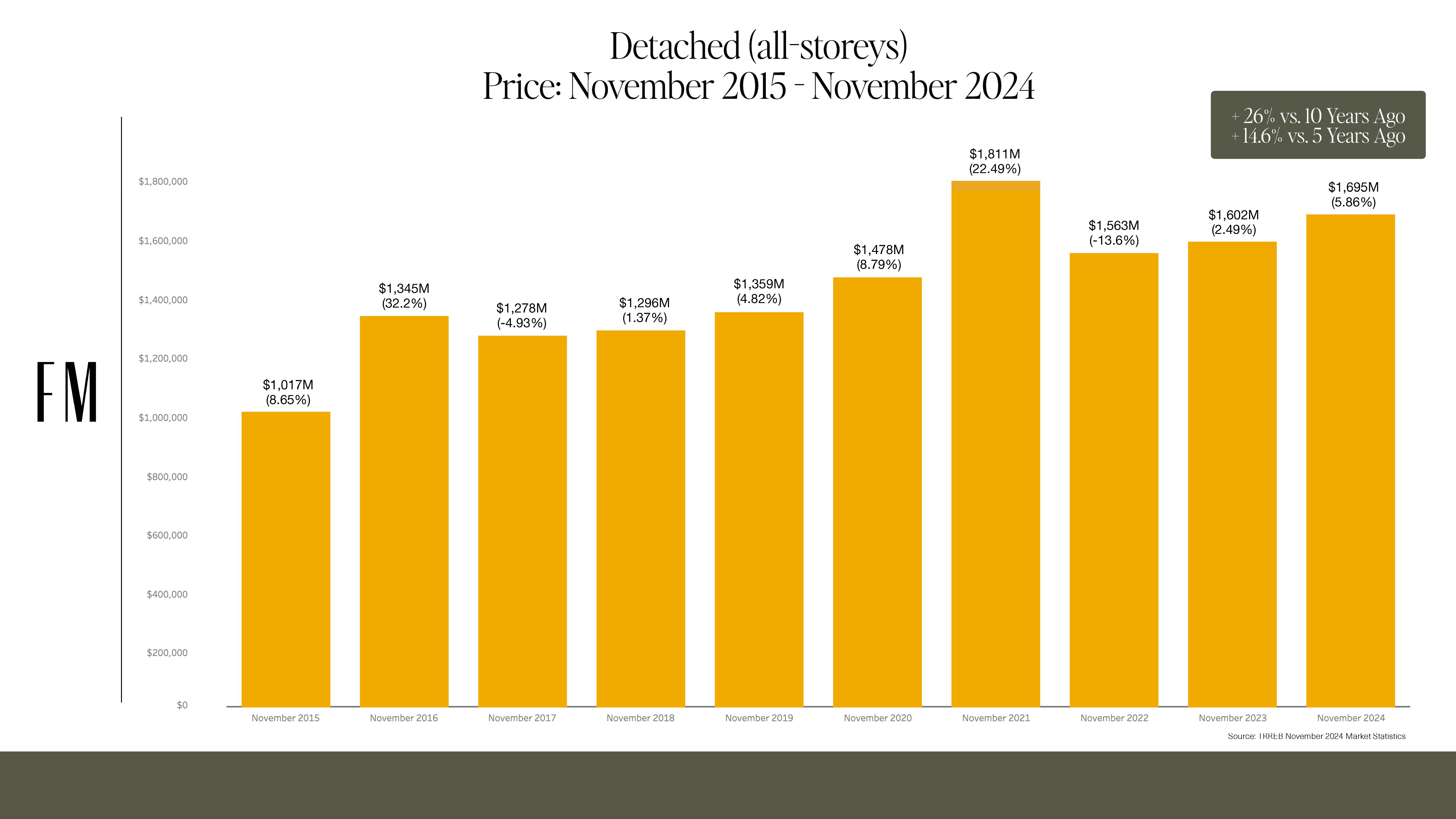

Pricing: A Decade in Perspective

The average price of a detached home in November 2024 was $1.695 million, reflecting a 5.86% increase year-over-year. While still below the November 2021 peak of $1.811 million, this slow and steady climb indicates resilience.

Key takeaways:

Days on Market: A Shift in Buyer Behaviour

On average, detached homes took 25 days to sell in November, an 18% increase compared to 21 days in 2023. This slower pace reflects:

Globally, this timeline remains brisk. In markets like the U.S. or Europe, homes often sit for months or years before selling.

Why Semi-Detached Homes Are Popular

Semi-detached homes—those sharing one wall with a neighbour—are often the next step for condo owners seeking freehold ownership. This category is particularly attractive due to its:

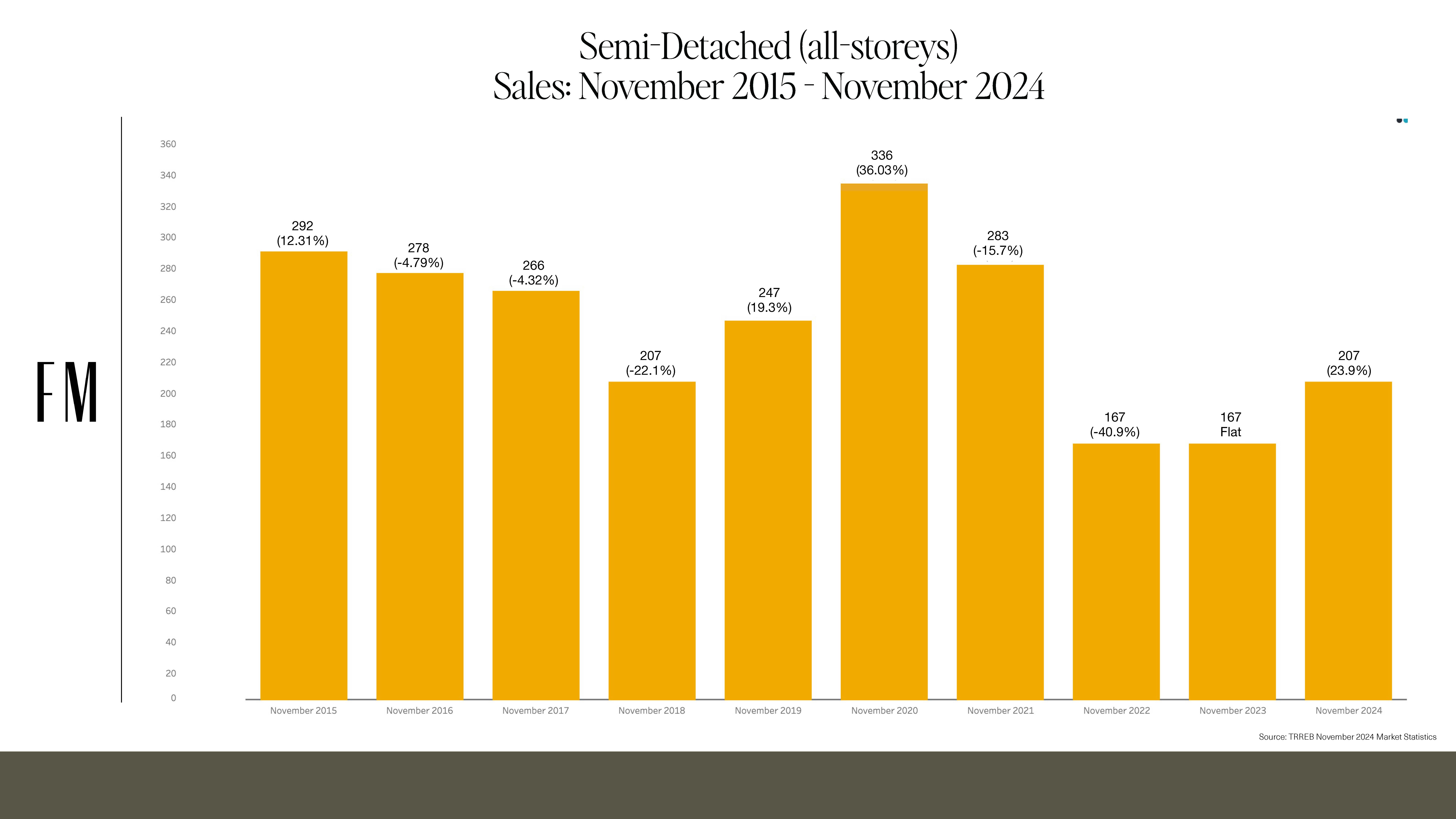

Transaction Volume

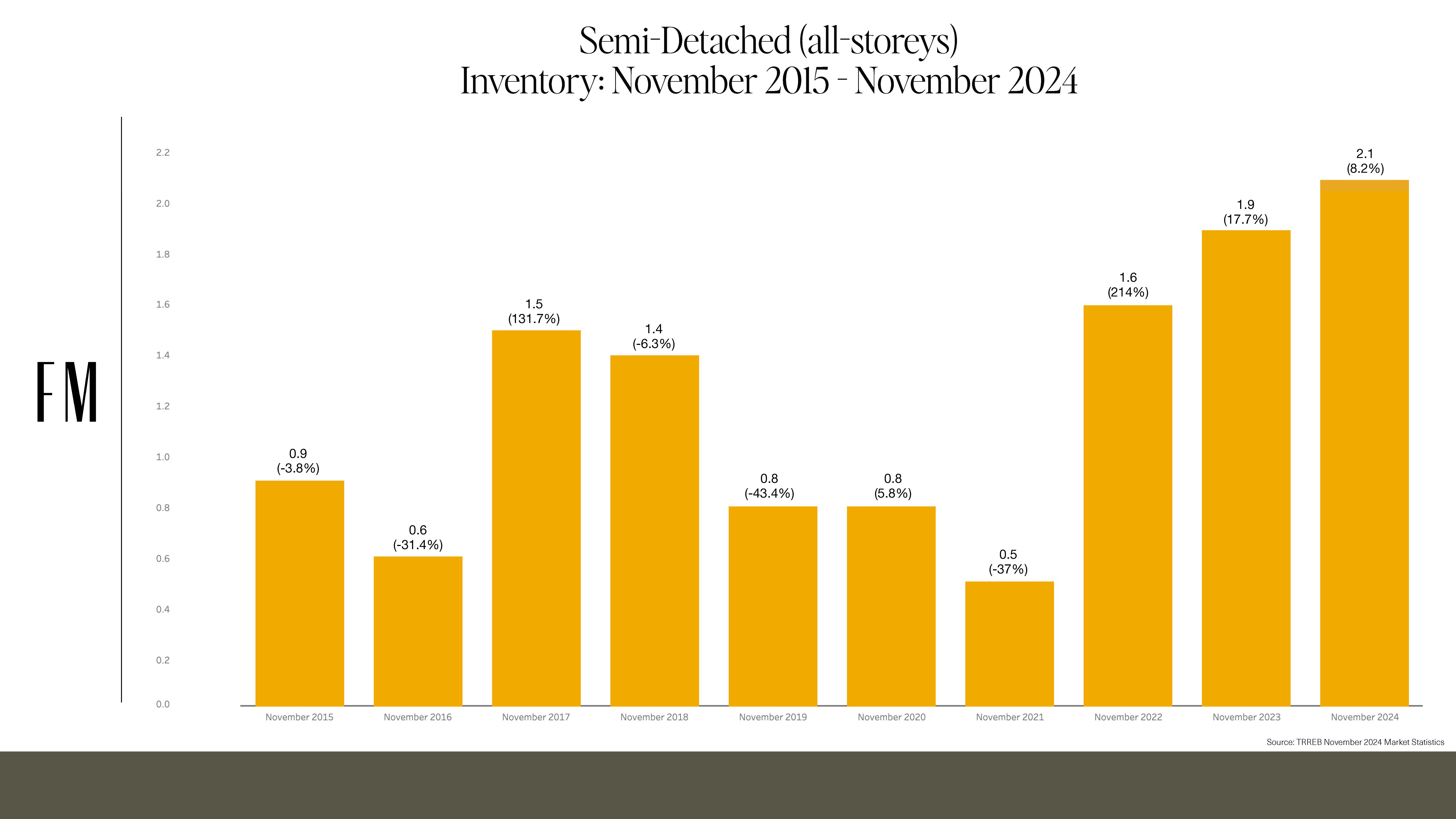

In November 2024, 207 semi-detached sales occurred, up 23% year-over-year. While this number is below the 10-year average of 250, it represents a recovery from the lows of 2022 and 2023. Expect increased competition in this category as lending rules boost demand in 2025.

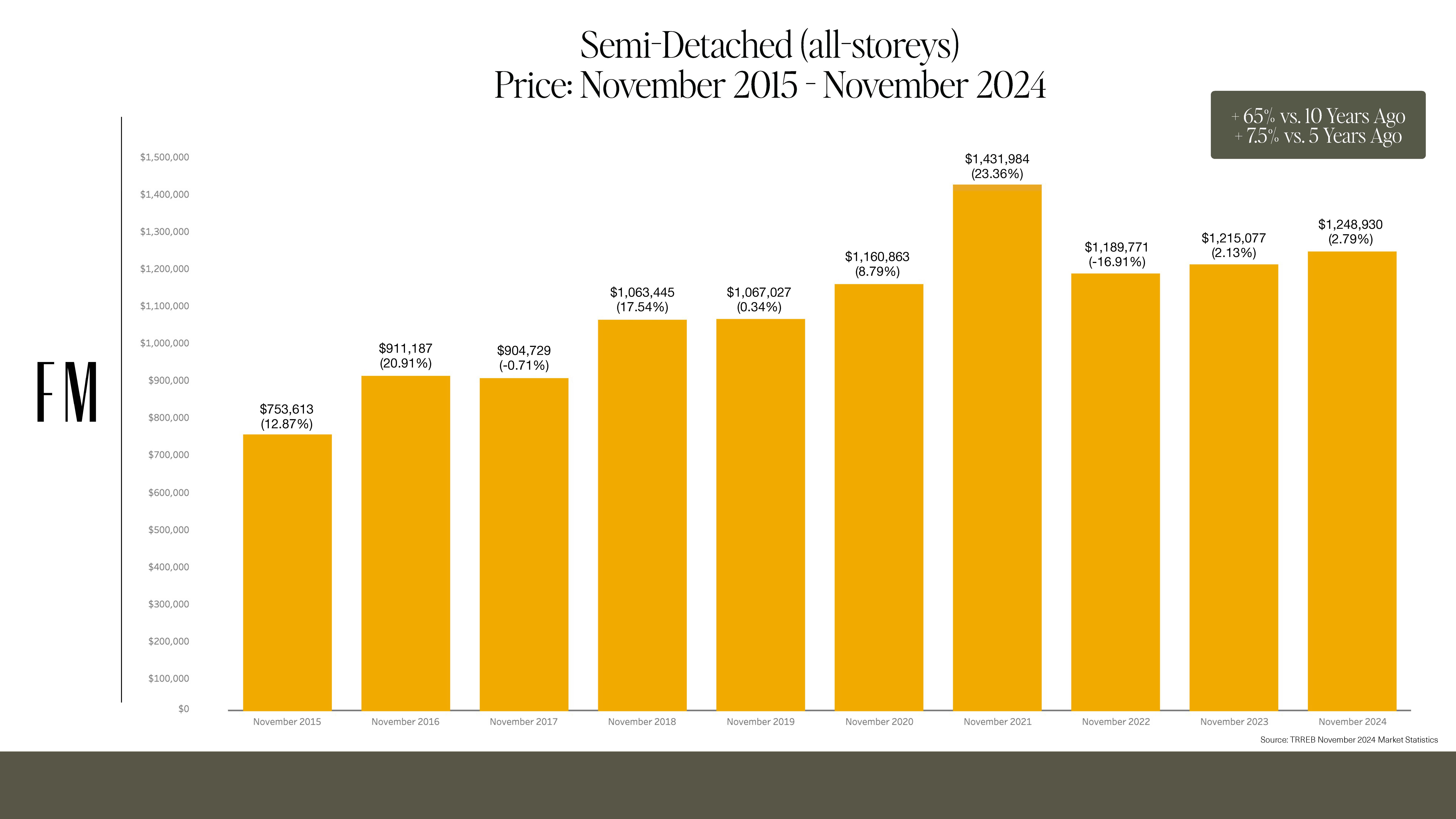

Pricing and Appreciation

The average price for a semi-detached home in November 2024 was $1.248 million, up 2.7% year-over-year. Over the past decade, prices have appreciated 65%, making this a lucrative segment for long-term investors.

Days on Market

On average, semi-detached homes took 21 days to sell, a slight uptick from 19 days in 2023. Buyers enjoy the opportunity to include offer conditions, a luxury that may fade as competition heats up.

A Struggling Segment

Condos have faced significant headwinds due to their high investor ownership (60%-70%), making this segment highly sensitive to interest rate changes. While the market has been challenging, it’s not the catastrophic decline some predicted.

Transaction Volume

In November 2024, 1,100+ condo transactions took place, a 37% increase year-over-year. Although volumes are still below their 2021 peak, they signal some stabilization.

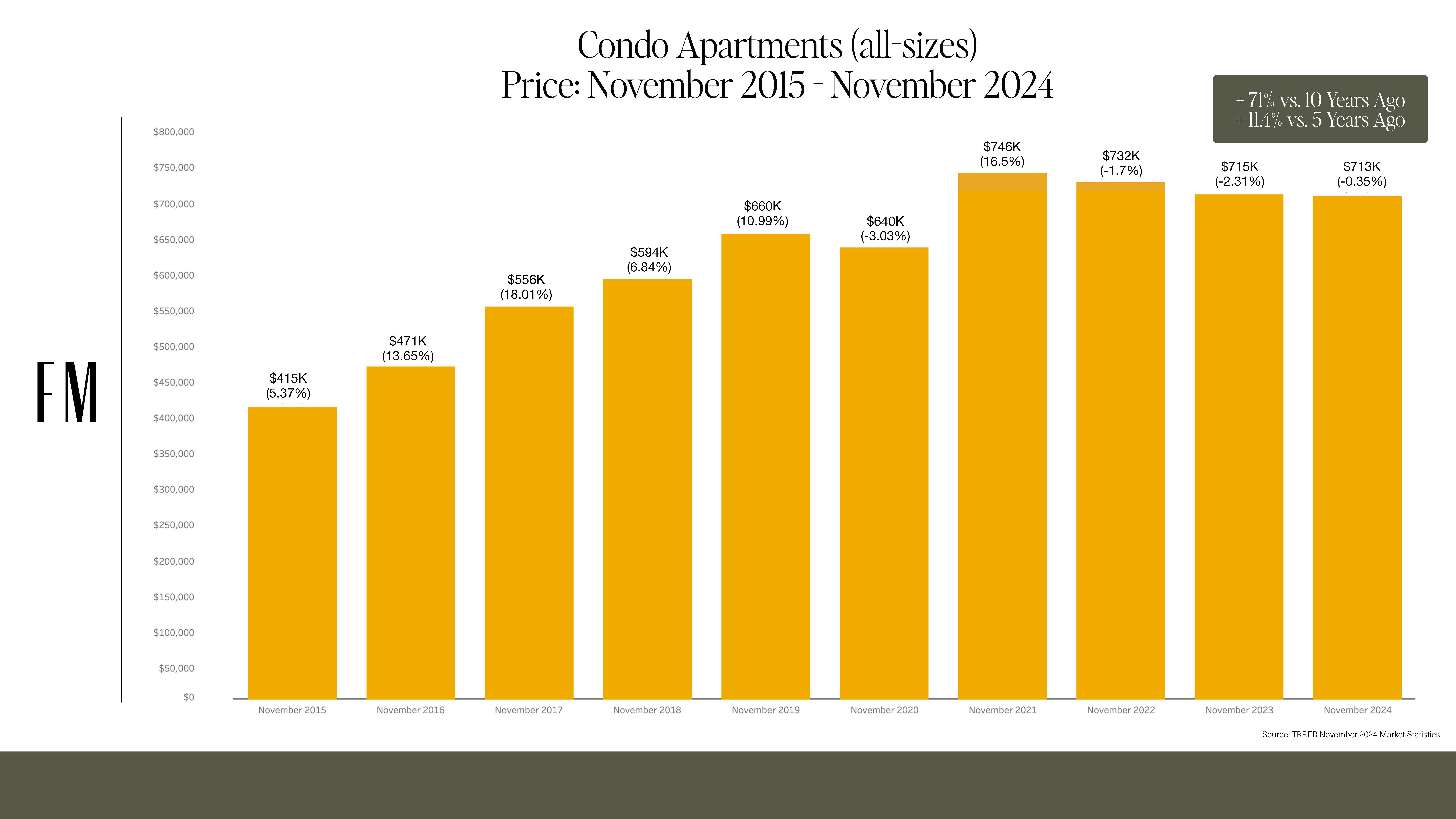

Pricing Stability

The average condo price in November 2024 was $732,000, reflecting an 11.4% increase over five years. While prices haven’t soared, they’ve shown resilience against the backdrop of higher inventory and reduced investor activity.

Days on Market and Inventory

Condos took an average of 36 days to sell in November 2024, up from 28 days the previous year. While still high, inventory levels have decreased 13.8% year-over-year, suggesting that the market is slowly absorbing the supply.

Key inventory observations:

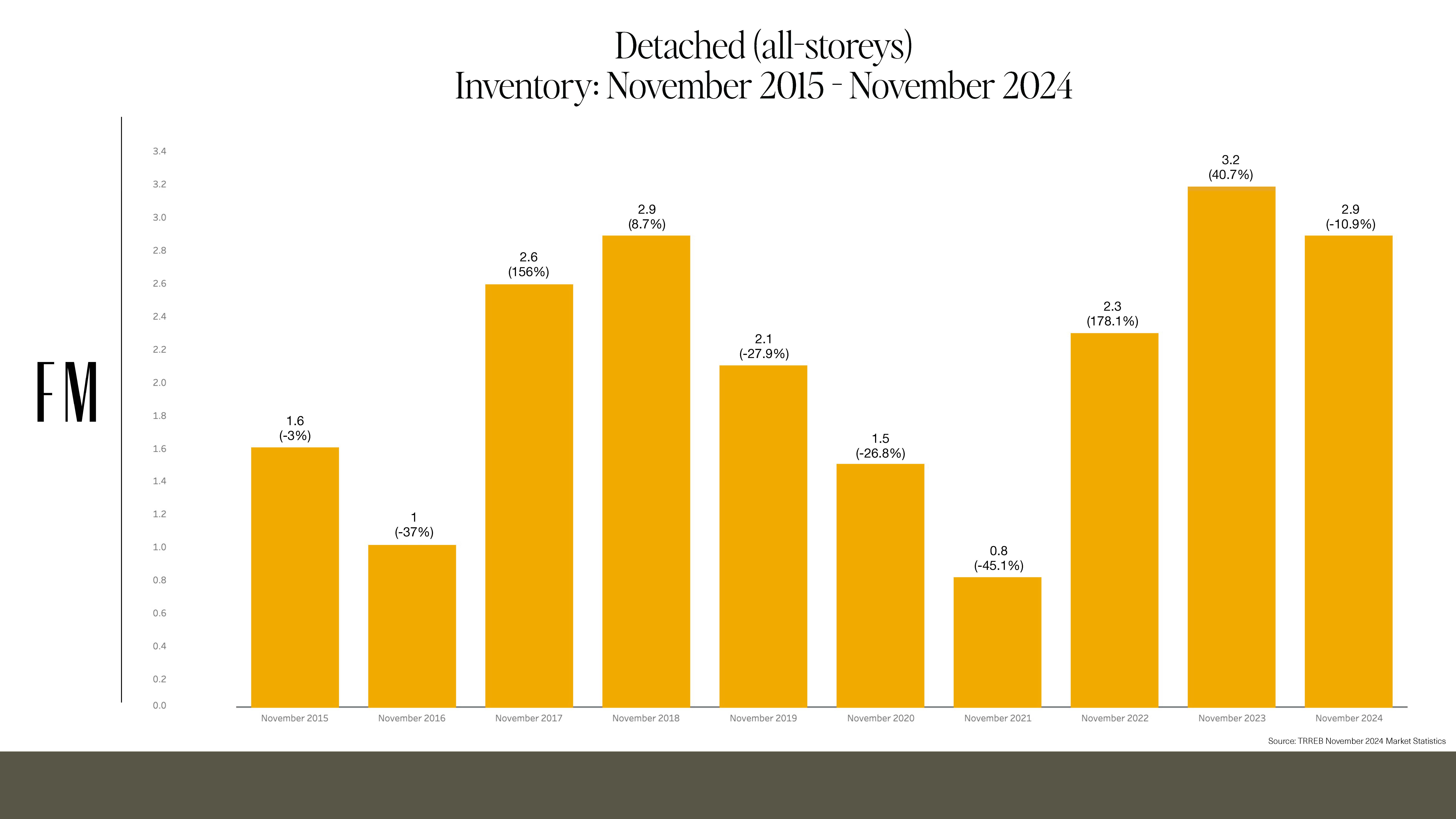

Inventory remains a critical metric for understanding Toronto’s real estate market. As of November 2024:

For buyers and sellers, understanding inventory trends can help inform decisions and timing. If you’re unsure what this means for you and your real estate planning, drop us a note anytime.

Looking ahead, several factors will shape the market:

Toronto’s Real Estate market in 2024 was a year of uncertainty, resilience, and gradual recovery (albeit slight). Detached and semi-detached homes strengthened while the condo market navigated a challenging landscape. As we move into 2025, staying informed and data-driven will be critical for buyers, sellers, and investors.

If you have questions or want specific data for your property type, please drop us a note anytime at hello@foxmarin.ca. Here’s to a promising 2025 year ahead, my friends!

Take the first step: The high-stakes Toronto Real Estate Market can feel fast-paced, highly transactional, and overwhelming. Real estate is inherently personal, and it is not a one-size-fits-all solution, and we get that. You deserve to have the best possible representation to achieve your goals. Seamlessly. Take control of your future today by answering questions about your goals utilizing our Buyer Intake Form.

Contact us (We’re Nice).

Fox Marin has earned its reputation as Toronto’s premier downtown luxury real estate team, backed by over *$580 million in sales, more than 1,000 successful transactions, and over 450 glowing 5-star Google Reviews. Discover the advantage of working with a proven team with a track record for winning results.

(*Source: Jan. 1, 2018 – Sept 1, 2025, RE Stats Inc. & Exclusive)

—

Kori Marin is a Toronto Broker & Managing Partner at Fox Marin Associates. For high-energy real estate aficionado Kori Marin, a well-lived life is achieved by maintaining an “all-in” attitude that realizes every last ounce of one’s full potential. This mindset has driven successful results in every aspect of her life – from her corporate sales and account management experience to her international travels to her years of fitness training and leadership – and is the hallmark of the exceptional work that she does on behalf of her clients in the residential real estate sector in downtown Toronto.