Has The Toronto Bubble Finally, Popped?

Counter to all doubt and uncertainty circulating the various media outlets, barbershops, cocktail parties and most Toronto real estate-obsessed circles, our long term prognostication for the Toronto real estate market remains the same and unabated: the “Manhattanization” of Toronto will continue to happen.

Over the last 18 months, the Toronto real estate market has withstood an unprecedented onslaught of small-minded, short-term policy tinkering, causing the market to take a brief pause. As you start to cut out the noise and peel away the drama, look at the big picture for what it is. What emerges is the vision of Toronto as a world-class city where long-term demand for real estate remains strong. Already, constrained supply continues to falter. As Toronto based developer, Brad Lamb succinctly put it, “our future is lower sales volume, more tenants, and higher prices. Toronto will not go backwards for any sustained period.” And, I agree.

When it comes to the Toronto real estate market, the media and industry analysts tend to overcomplicate things. Or, they focus on the mitigating factors rather than the actual drivers. For this discussion, we will strip the superfluities away and go back to basics.

Let’s look at what matters most: both current and future demand and supply levels, and how it will impact pricing both for the long- and short-term. Here are six defining factors that drive the Toronto real estate market, this year and beyond.

The first key component to knowing the nuances of Toronto’s demand for real estate is understanding immigration. In their November Report, the Government of Canada increased its immigration targets for 2019 – 2021. This allows for the arrival of 1.3 million new permanent residents between 2018 and 2021. Canada is now the fastest growing country in the G7. Its population growth is at a rate of 1.4% per year. Why is this happening? Ahmen Hussen, Canada Minister of Immigration, emphasizes our ability to grow, attract, and retain top talent. Hussen explains, “growing immigration levels, particularly the economic class will help us sustain our labour force, support economic growth, and spur innovation.”

In Toronto’s 2018 RFP pitch to win the bid for Amazon HQ2, the city set its sights on differentiating Toronto and Canada from the U.S. and its American cities. Toronto stated, “immigration is not a problem in our country, it’s a solution.” More than this, “51% of our city’s population is born outside of Canada. Torontonians speak over 180 languages and dialects and, is regarded as the most multicultural city in the world. Our labour force and economy benefit directly from our diversity and inclusivity. We build doors, not walls and those doors open to highly-skilled, economic immigrants and international students who can easily become permanent residents and citizens.”

Over the last few years, the net average population has increased with the GTA hovering around 100,000 new immigrants per year. Take a minute to consider what this means. Imagine every man, woman and child currently living in Halifax, moving to Toronto in the next four years.

The province of Ontario estimates that by 2031, the population of the GTA alone will reach 8.5 million. This is approximately the current population of London, England. In fact, some estimates are that the GTA will need to produce as many as 500,000 new homes between now and 2031 just to keep up with this demand. The current average is around 34,000 per year.

The demand for Toronto real estate is not only coming from outside the country, but it’s also coming from within. Currently, more than 7.3 million millennials are living in Canada. This makes them the largest age group since the boomers. According to a recent study put out by the Ontario Real Estate Association (OREA), in the Greater Toronto Area alone, 700,000 millennials will be in the market for a home in the next decade.

We have seen time and time again, millennials getting a boost, loan or outright purchase from the bank of mom-and-dad. Of course, the irony in all this being that the money is often coming from the equity on those parents’ own homes, their personal lines of credits, or their real estate investments. Much like the times of feudal Europe, wealth is being transferred down generationally through real estate. Over the next decade, you can expect this transfer of generational wealth to have a significant impact on the demand for resale sites in Toronto.

According to a CBRE study, Toronto is now the fastest growing tech-hub in the world. From 2012 – 2018, the city introduced 82,100 highly skilled and high paying job opportunities in the technology sector. And, in that same period, New York only added 27,000. Even Silicon Valley lagged Toronto in adding 77,800 tech jobs. For millennials or immigrants searching for tech careers in the new economy, Toronto is either where you want to be or where you will end up living.

The fact of the matter is, all the tech giants are either considering coming to Toronto or are already here. And, they’re putting their money where their mouth is – buying, renting and developing downtown real estate. In fact, Google is in the process of developing the world’s first Smart City in Toronto. This is expected to revolutionize the way cities are built and experienced. It is slated for construction on Toronto’s east end. The estimated investment for our city in the Google Development alone is enormous! On the west end, Shopify just doubled down on its Toronto presence. They’ve committed a half billion dollars to a new home that’s currently under construction at Front and Spadina. Not to be outdone, Uber will also be spending hundreds of millions on its new downtown Toronto facility.

In the past, Toronto has been criticized as only being a financial and services hub. But today, the city is no longer a one or two trick pony. We’ve further diversified our economy by becoming a world leader for tech hubs.

For the last four years, Toronto has had the lowest office vacancy rates in North America. This is now hovering at around a 0% vacancy rate. And, it’s almost in direct parallel to our residential vacancy rate, which is now at 0.7%. Make no mistake, there is a direct correlation between the two. Top talent wants to live and work downtown, and corporate Canada is listening.

On the office front, Toronto is absorbing one million square feet per year and is simply not able to keep up. Downtown Toronto is where all the action is happening. In a recent Globe and Mail feature, Stephen Wicks aptly titles his article, “Toronto Can’t Build Towers (office and not condos) Fast Enough”. He cites that, “There’s 10.1 million square feet of new office space in the pipeline for Toronto’s core, but with none of it slated to open for more than a year, there’s apparent consensus that demand will further outstrip supply in 2019 – and that’s in a market that has already been North America’s tightest for more than four years.”

Further to this, he quotes Daniel Holmes, Senior Managing Director at Colliers International, “Americans I’ve talked to are amazed. I can’t believe this hasn’t been making headlines.”

The great irony of the Toronto real estate market is that the media attention is focused so much on condos. Because of this, they are missing one of the biggest drivers going up right beside us and in front of our eyes.

When you have an ever-increasing high concentration of capital paired with highly paid talent, the impact will result in severe upward pressure on the housing stock. For this to happen in a city like Toronto where we are already challenged with residential supply, you can imagine the consequential effects – more on this later!

If you can’t make it in Toronto, you can’t make it anywhere!

When looking at the Toronto real estate market, both economists and the press often speak to the performance of the overall Canadian economy. However, this only paints a picture of one half of the story. With a local economy of $332 billion, Toronto is responsible for almost one-fifth of Canada’s overall GDP.

Source: Stats Canada, via Urbanation

A recent report from the City of Toronto noted that we have maintained a GDP growth rate of about 3.4% for the past three years, above its population growth of 1.6%.

The average income for downtown Toronto households is at $125,000. This is up from 3.2% since last year and in line with appreciating housing prices in 2018.

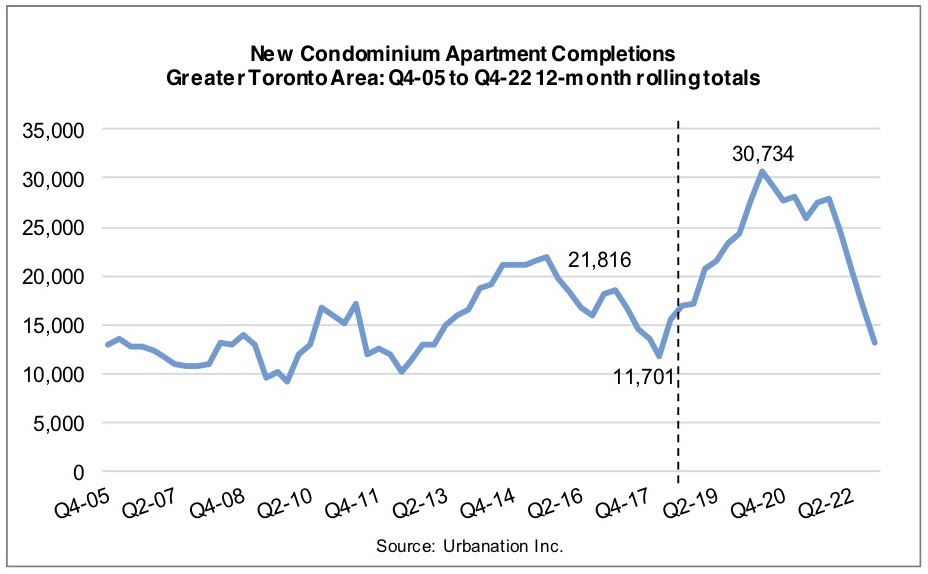

In the next three to five years, supply could drop as much as 30- 50%. Evan Sidal, Head of the Canadian and Home Mortgaging Corporation concedes, “if I were concerned about anything from a long-term housing market point of view, it’s the supply of housing in Toronto.”

Furthermore, in a CMHC report, over 20 new homes were built in Toronto for each one demolished in 2016. This is dramatically different from 2011 where the replacement rate was 70 to 1.

Marred by government red tape, the time and costs to go through zoning is astounding. This causes a bottleneck for developers bringing properties to market. Bryan Tuckey, Former Head of BILD stated, “developers now have to satisfy about 200 conditions, from protecting species at risk to transport requirements, to get municipal approval. That compared with about 25 at the start of the last decade. Despite the growth plan’s preference for multi-family housing, such projects can now take more than three years to complete, double what it was 15 years ago, because of a surge in required documentation, out-of-date municipal zoning bylaws and residents’ opposition to high-rise projects.”

When The Places to Grow Act, 2005 created the green belt around the perimeter of the City of Toronto, it put constraints on the availability of developable land in the GTA. In turn, causing prices to rise dramatically. Berry Fenton, head of Lanterra notes, “it is very difficult to acquire land anymore that makes economic sense. Most land under development today was bought by developers decades ago.” The average gross buildable area per square foot (fully approved) in the downtown core is trading at $215-$225. In fact, developers that are buying at today’s prices most likely will be land banking for the foreseeable future.

In an Urbanation forecast, it illustrates that after delivering a surplus inventory in 2019, condo deliveries in the GTA will fall to all-time lows and there will be little signs of relief for 2022 and beyond.

Another key supply issue facing the Toronto and GTA housing markets is the double Land Transfer Tax imposed on residents of Toronto. This directly reduces mobility, discourages right-sizing, and ultimately, lowers the number of homes for sale and choices for buyers.

Currently, no other Ontario municipality has the legal authority to levy a municipal land transfer tax. And, once Torontonians consider the transaction costs of moving, of which land transfer taxes are often the most prominent component, most choose to stay put and renovate. In turn, this creates less supply and choice for potential purchasers.

When learning to hit a target, the best advice is to keep your eye on the ball. While some may view the fundamentals for the Toronto real estate market as a moving target, it is anything but. Our biggest collective failure as a city has been at the result of keeping our eye on the wrong ball. We tend to focus on demand when we should be looking at and encouraging supply from the private sector.

CIBC economist Benjamin Tal, furthers my point in saying, “we’re using demand tools to fight supply issues. It is lagging way behind and the solution to the supply crunch may reside with Municipal and Provincial Governments, and it isn’t about taxation or lending policy; rather it is about being proactive with policy combined with the easing up of fees associated with building to promote the introduction of new supply into the marketplace.”

We are at a place and time now where given the size and velocity of Toronto’s growth, there is no real turning back. Smart, effective policy can help mitigate and relieve some of the inventory pressures. However, it will not be able to eradicate it.

Higher borrowing costs and the stress test had a short term dampening effect on the market in 2018. I expect that this will continue to have somewhat of an impact in 2019 as well. As more qualified buyers who were on the sidelines with a wait-and-see attitude in 2018 realize the sky did not fall and begin to look again, they will become more active in their search this year. And, we’re already starting to see this in the tail end of 2018.

TREB reported that in 2017, there were 92,263 real estate transactions. With a 16.1% drop in 2018, there were only 77,426 transactions with new listings down by 12.7%. You can expect sales volumes to remain at around this level for 2019.

The effects of the Government’s Stress Test eroding affordability and making home ownership out of reach for many will put further pressure on the rental market now at a near zero vacancy. Some of this pressure will be alleviated by a record number of new inventory being delivered later this year. However, it will not be enough. Look for rental rates to lead the Toronto market with an appreciation of 5-7%.

Overall, the residential market in central and downtown Toronto will remain robust. Homes and condos under 1.2 million (if you can find them) will lead the way. Furthermore, expect the Toronto real estate market to outperform inflation with an average appreciation of 3.5% in 2019.

Having grown up in this city, the change and growth in Toronto is like watching something move so fast, it almost appears to be moving in slow motion. Take a step back and it becomes evident how quickly this sleepy town has evolved. It’s grown into a dynamic cosmopolitan player on the world stage.

Without a doubt, in three to five years from now, Toronto real estate prices will be considerably higher than they are today. The question is, what are you going to do about it?

—

This article is written by Ralph Fox, Broker of Record and Managing Partner here at Fox Marin Associates. Ralph is a Torontonian native who recognized from an early age that the most successful people in life apply long-term thinking to their investments, relationships, and life goals. It’s this philosophy, along with his lifelong entrepreneurial drive and exceptional business instincts that help to establish Ralph as a top agent in the real estate market in downtown Toronto.