Has The Toronto Bubble Finally, Popped?

Canada finds itself in exceptionally turbulent times, with uncertainty dominating headlines and unsettling market dynamics. There’s the looming threat of a 25% tariff across the board from our neighbours to the south, a currently stalled and non-operational parliament, and a prime minister who’s announced his impending resignation without clarity on timing. Adding to the mix is an impending Liberal Party leadership transition, set to unfold in the coming days, further clouding an already murky landscape. Markets thrive on stability, yet what Toronto is experiencing right now is anything but stable.

With a constant flood of information and conflicting data, it can feel impossible to grasp the true state of Toronto’s real estate market. Readers are likely seeking clarity on what these developments mean for their real estate decisions. This article breaks down the latest data from the Toronto Regional Real Estate Board, offering clear insights amid the chaos. Ralph and Kori provide context, commentary, and clarity, equipping readers to navigate this complex environment. Despite initial apprehensions each time new data emerges, the reality often proves far less alarming than anticipated.

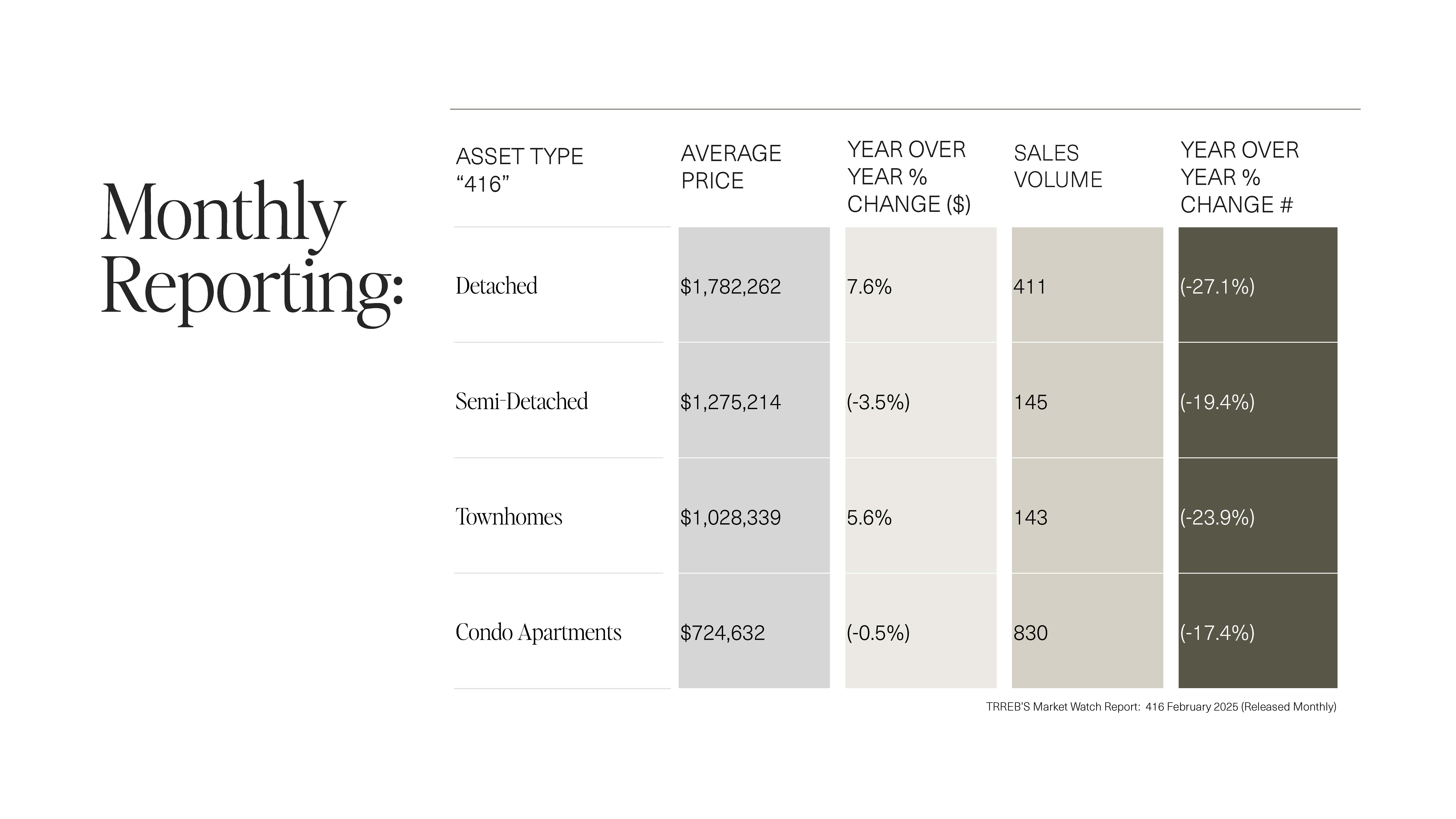

Looking at the main asset classes – detached, semi-detached, townhouses, and condos – we noticed prices have remained surprisingly resilient:

However, sales volume have significantly decreased, down by double-digit percentages across all categories. Clearly, fewer buyers and sellers are transacting compared to this time last year.

Important note: these figures represent central and downtown Toronto (416 area) and might differ significantly from suburban regions.

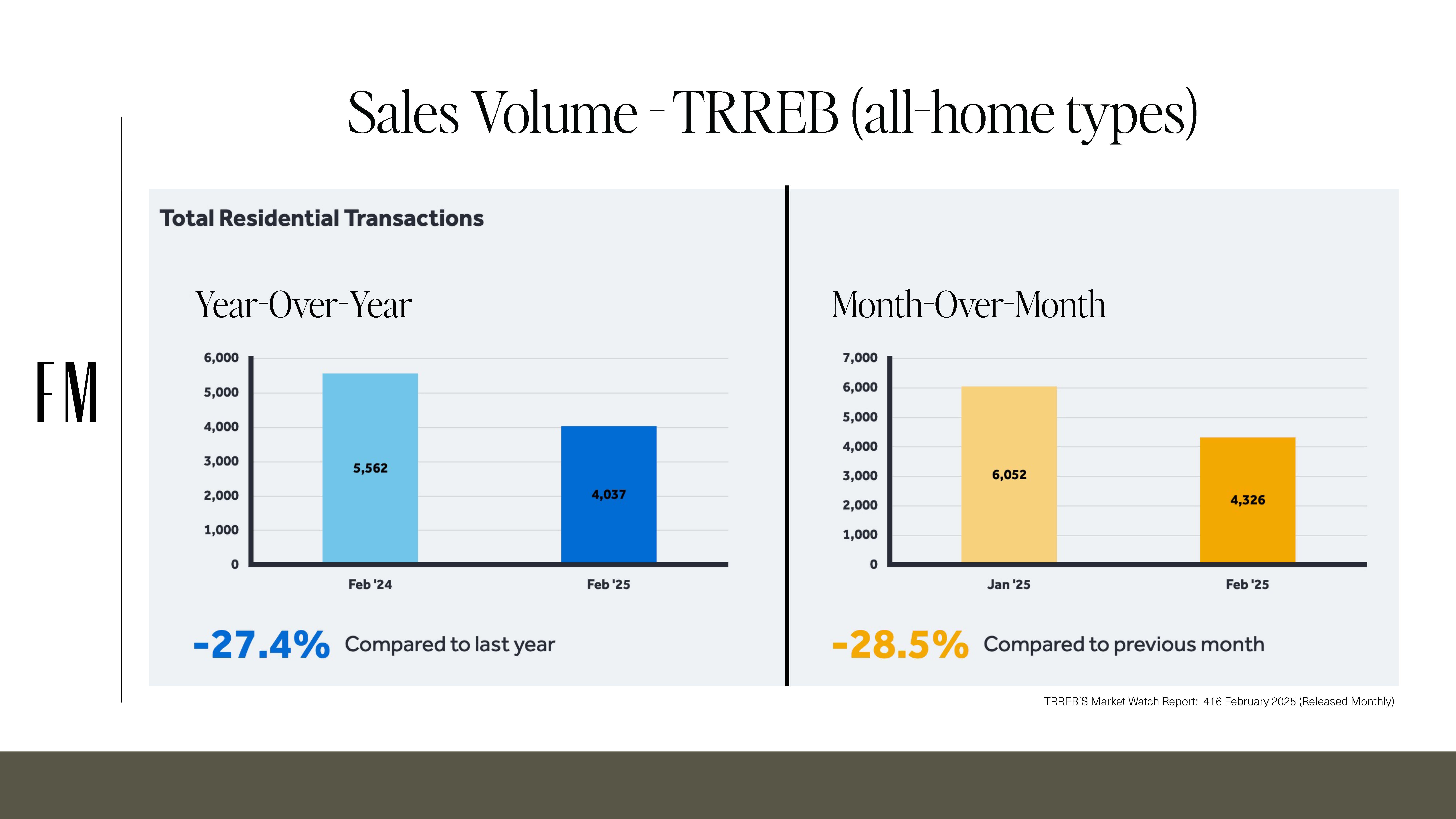

When we zoom out and look at the overall market through TRREB, total residential transactions have decreased by approximately 28%. Even month-over-month (January to February), sales dropped nearly 29%. This suggests a cautious, wait-and-see attitude among buyers and sellers alike, partly due to recent political and economic uncertainties.

New listings have slightly increased by 5.4% year-over-year, with condo listings notably driving this trend. We anticipate watching closely to see if this continues through Q1 and Q2.

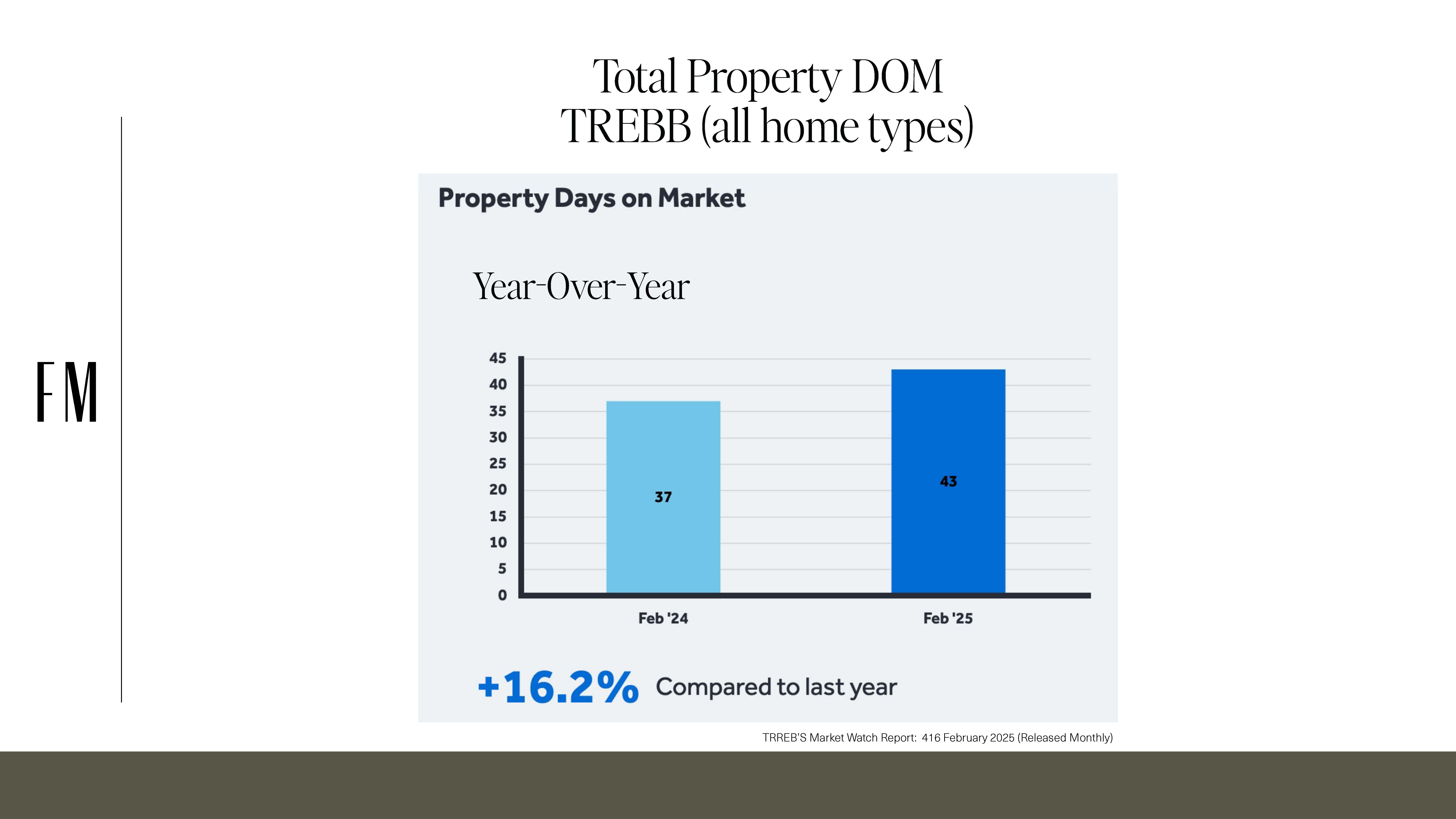

Properties are taking longer to sell – 43 days on average, a 16% increase from last year. Buyers now have more leverage, increasingly including conditions in their offers, which naturally extends days on the market.

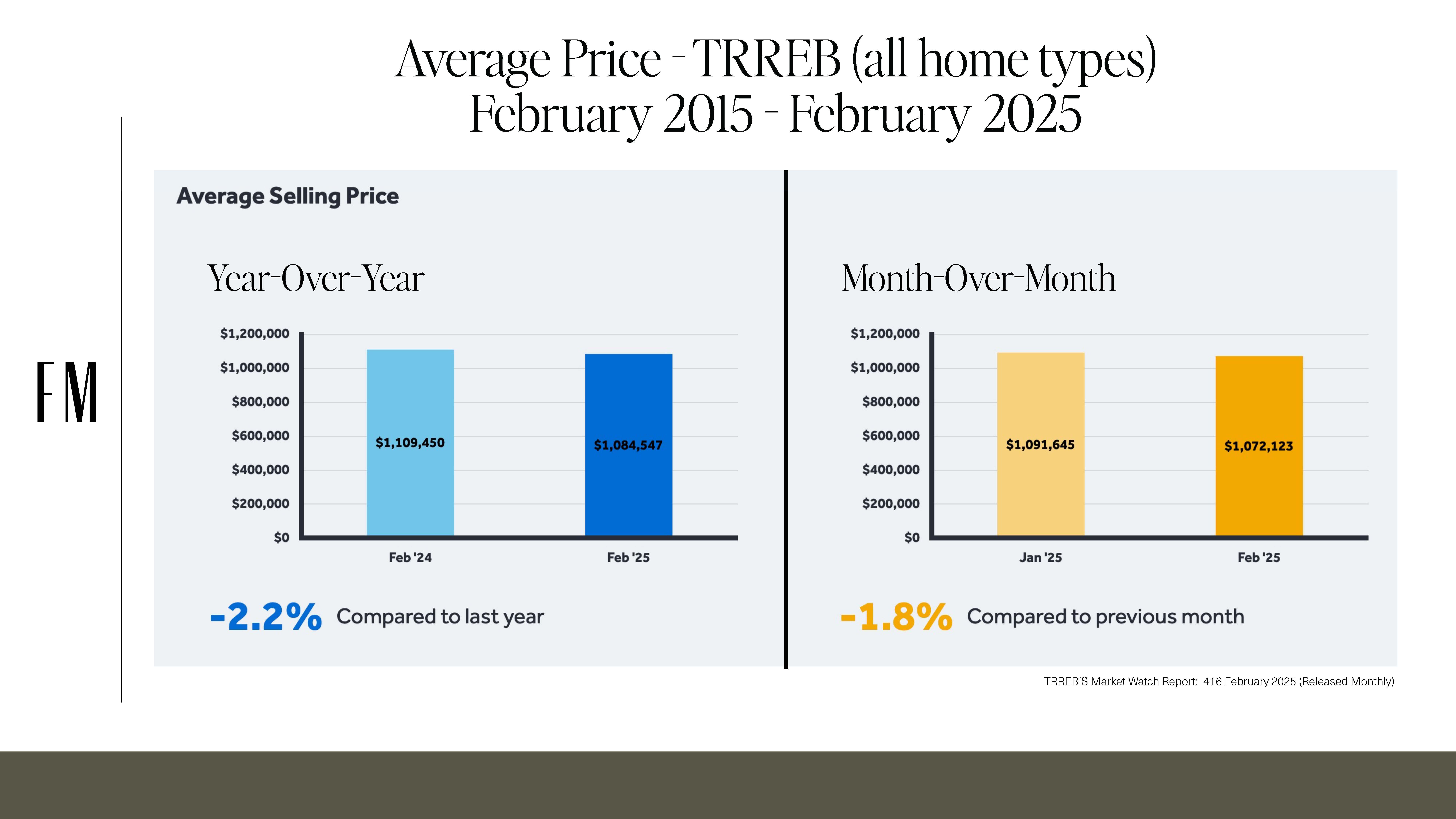

Despite turbulent headlines, average prices for all home types combined in TRREB are down only 2.2% year-over-year, and just 1.8% month-over-month. Ralph noted that market fundamentals are overshadowed by external factors, making predictions challenging. Yet, prices remain relatively stable – a pleasant surprise against a backdrop of uncertainty.

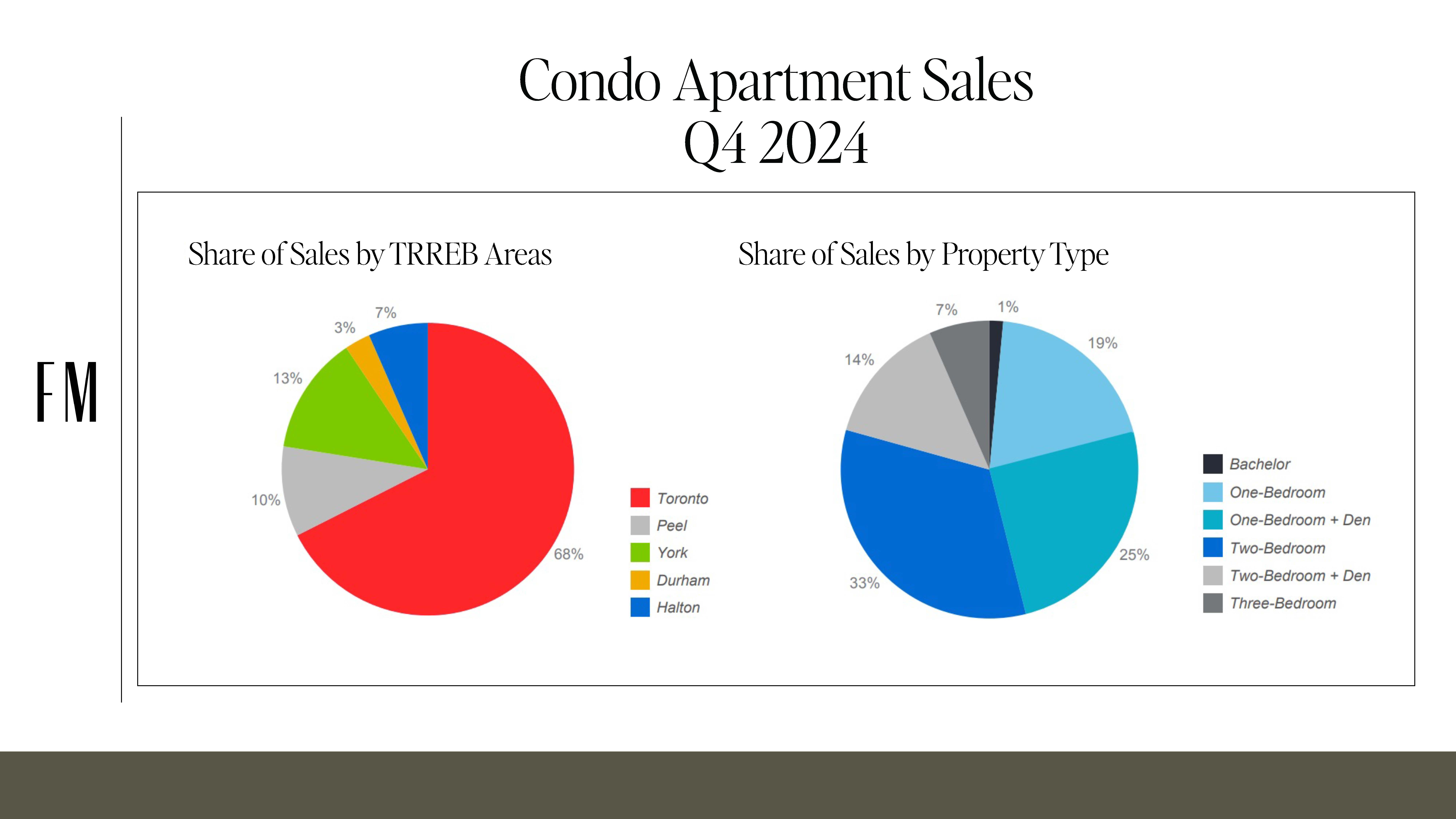

Condo sales volume surprisingly increased by 25% compared to Q4 2023 to Q4 2024, while condo prices dipped only 1.6%. Ralph suggests that higher-quality and larger condo units are driving the averages upward, masking weakness among smaller, investor-focused units.

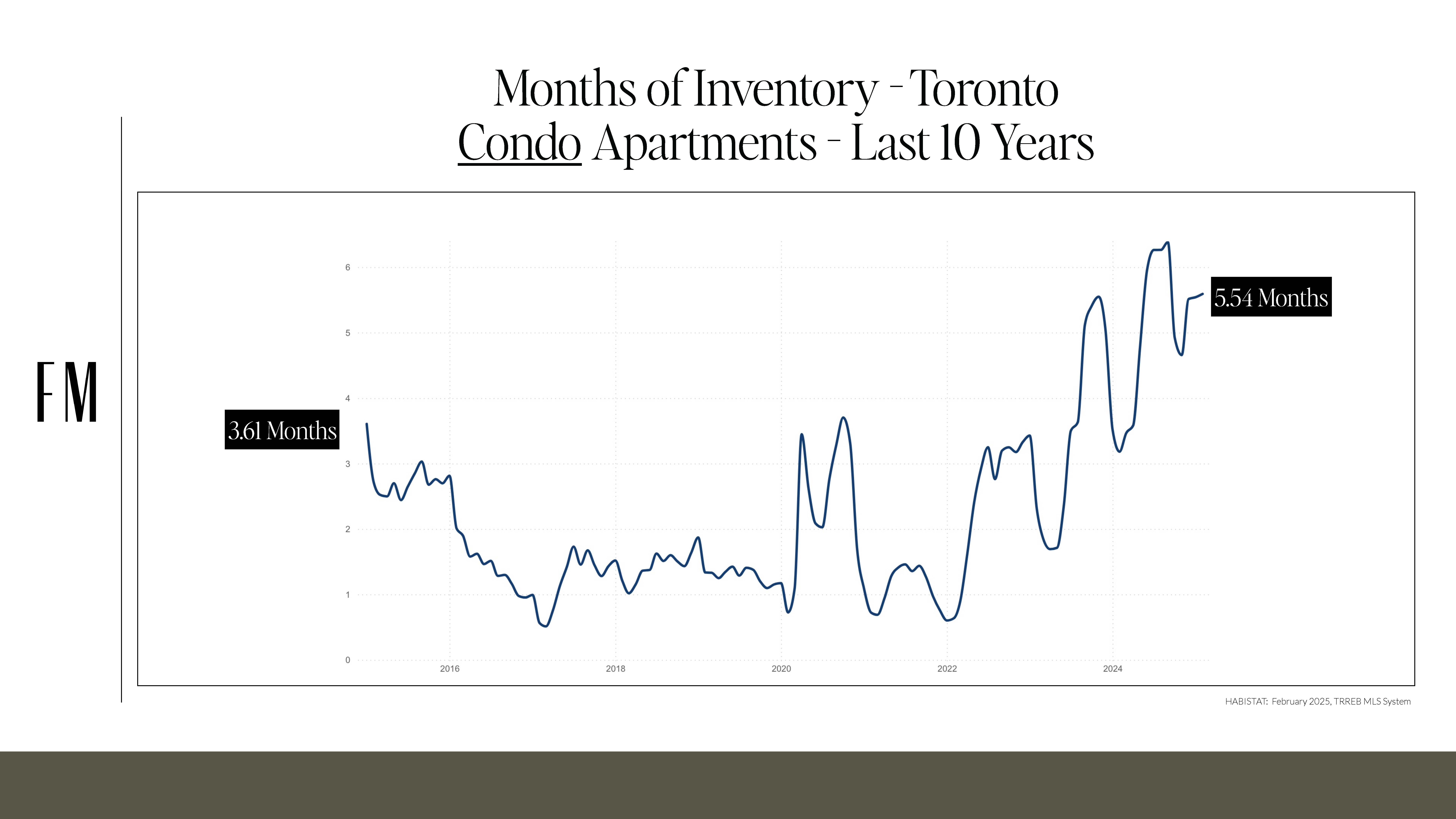

New condo listings are up 9.3% year-over-year, with days on market increasing by 23%. Condos, particularly smaller investor units, remain notably challenged, likely due to external pressures such as affordability issues and general economic instability.

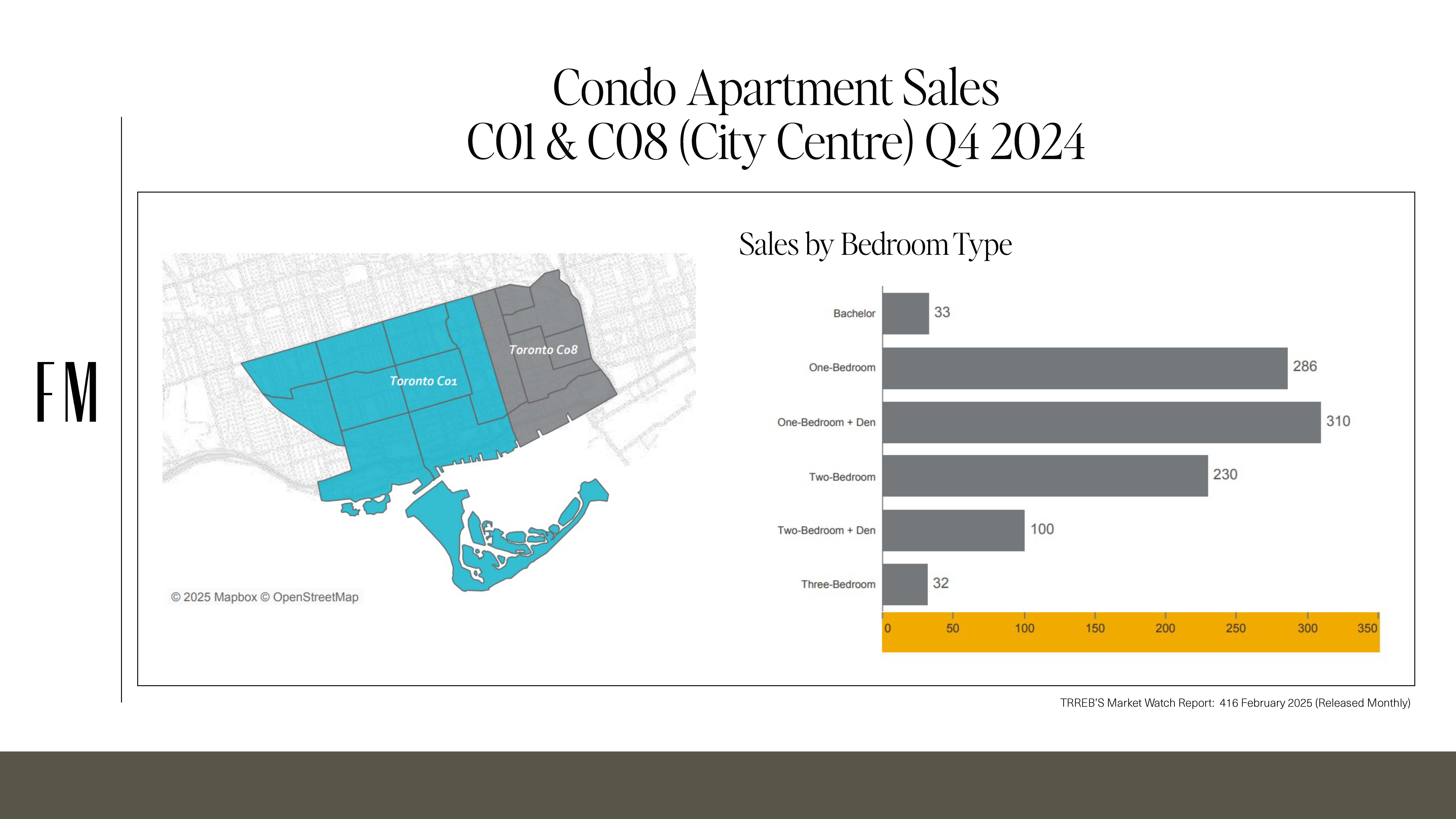

Toronto’s condo market, particularly downtown (C01 and C08), shows strength in two-bedroom units, making up 33% of sales, anticipating growing demand for larger units as single-family homes become increasingly unaffordable, predicting this trend to bolster the condo market in the future.

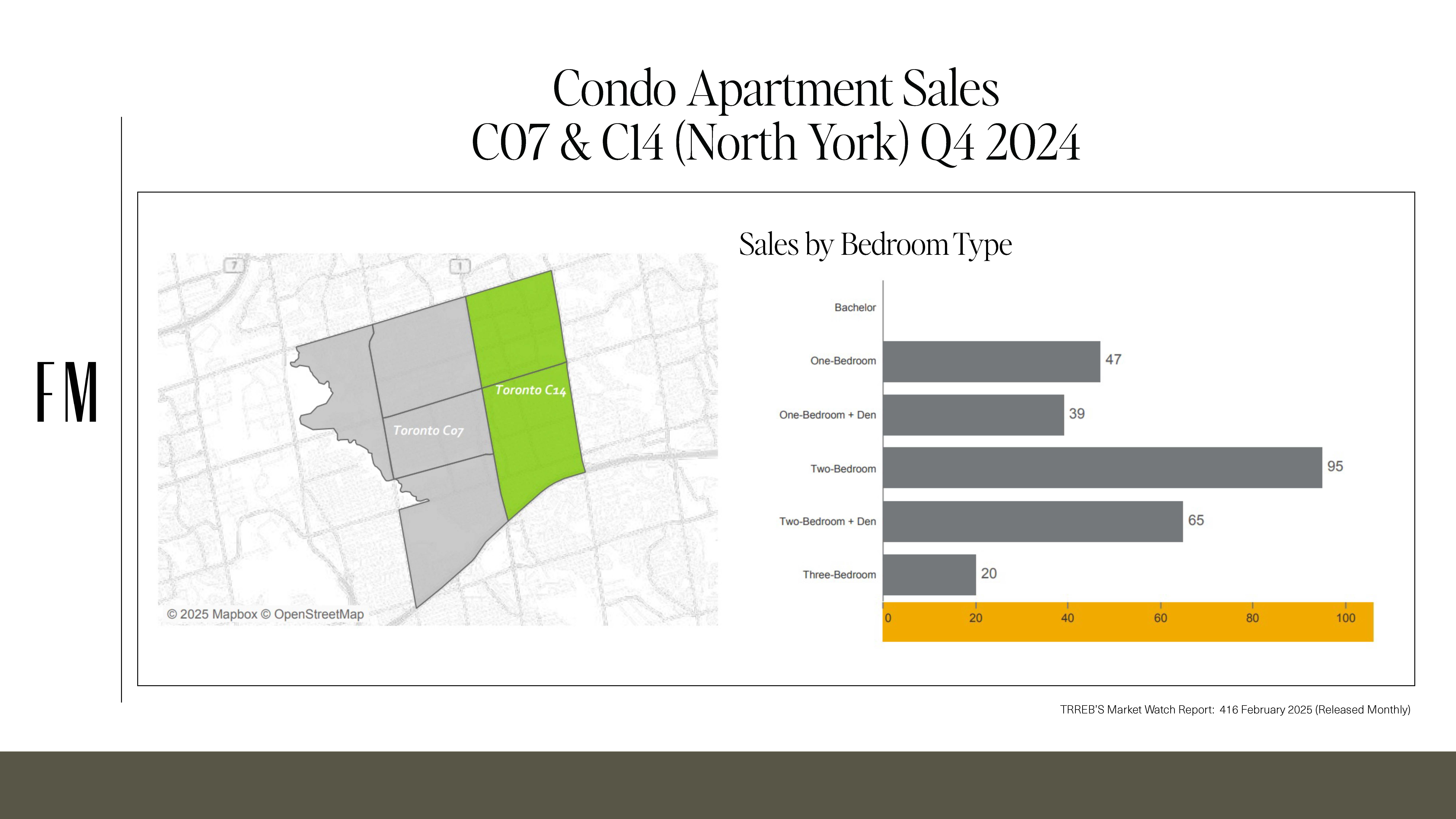

Meanwhile, North York (Yonge & Sheppard area) sees even stronger demand for two-bedroom units, driven by affordability and appeal to families and first-time Canadian homebuyers.

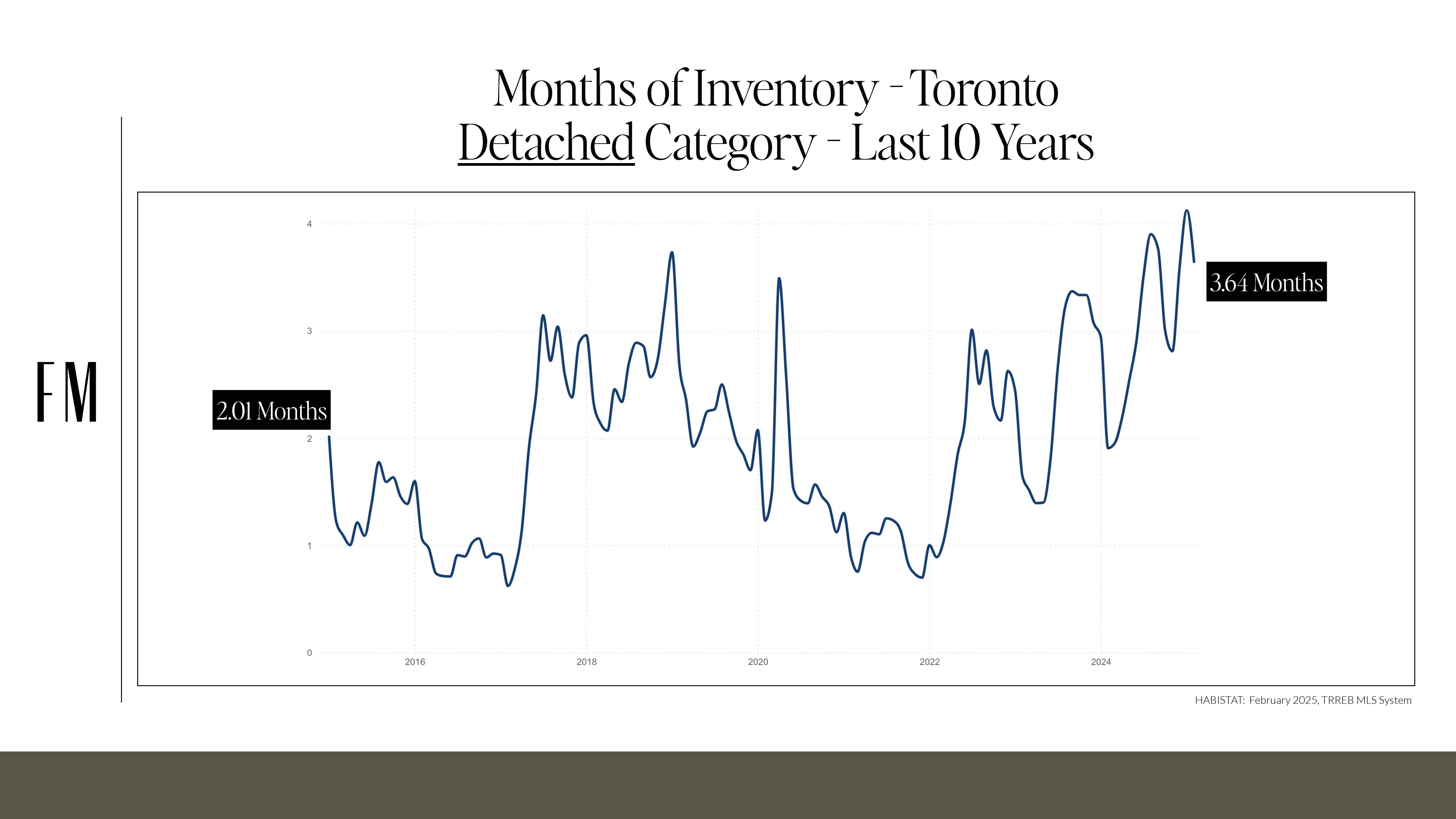

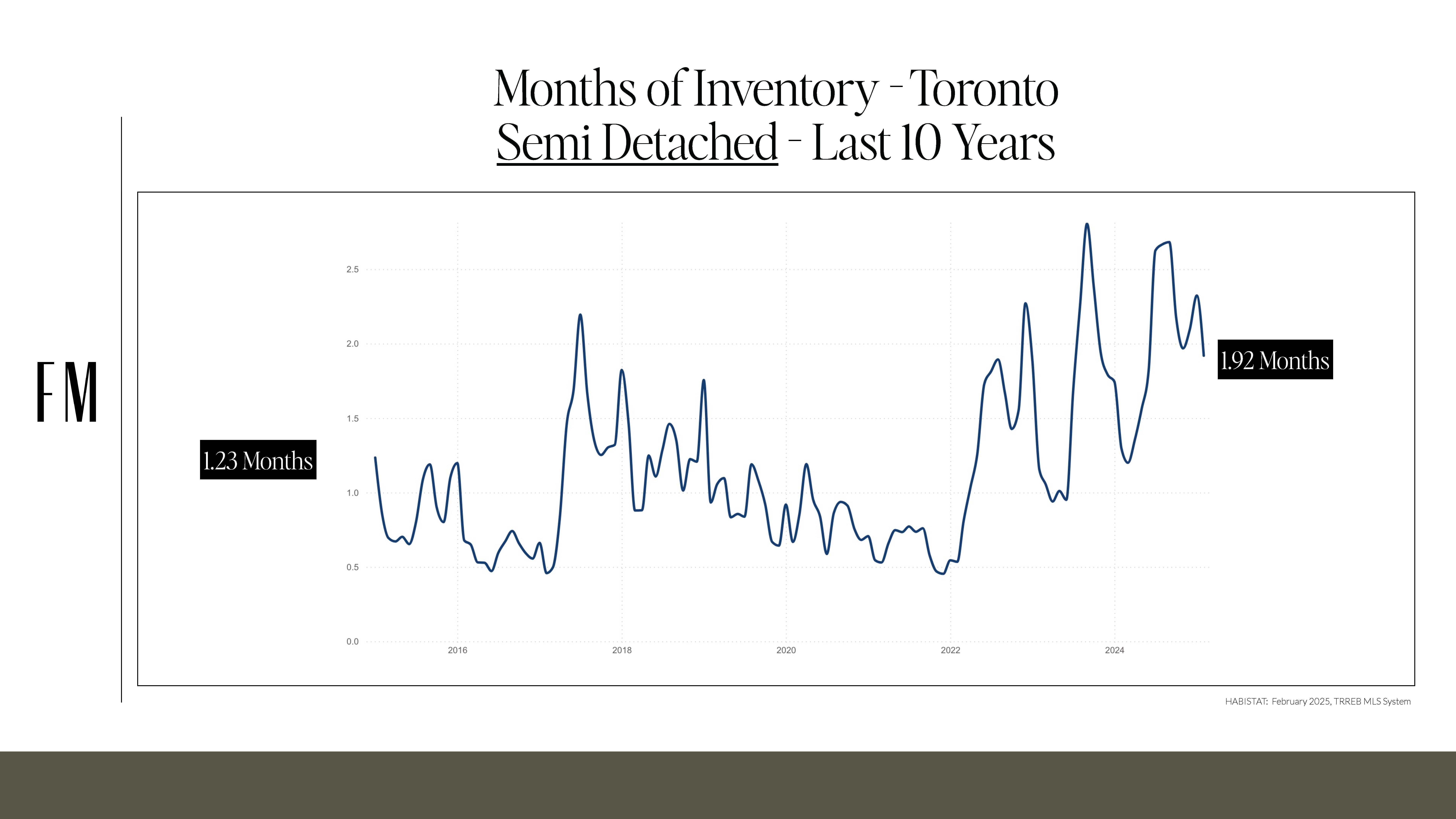

Inventory is a crucial indicator. It measures the time required to sell existing listings without new ones hitting the market.

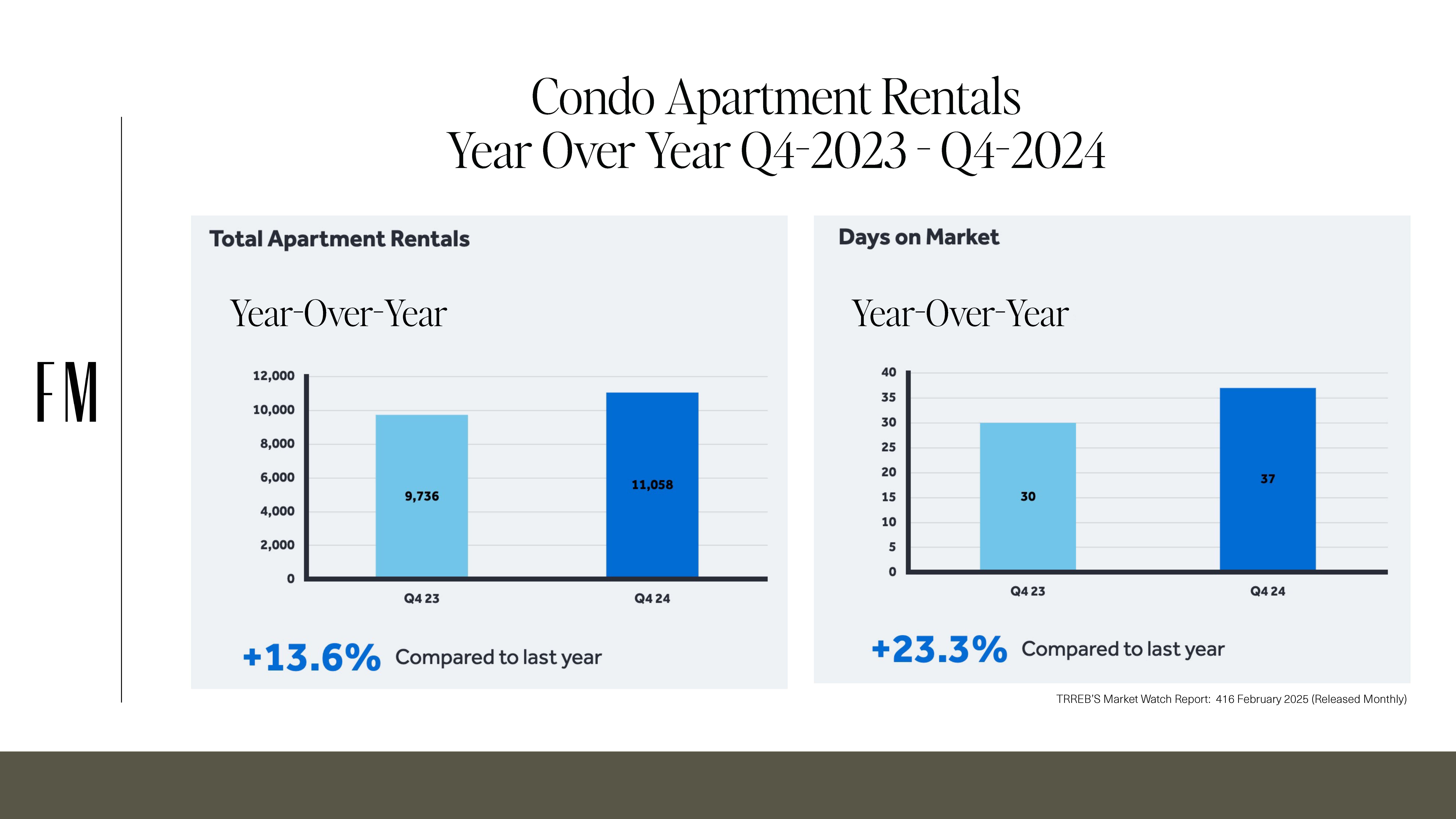

Rental activity increased by 13.6% year-over-year, while days on market rose by 23%. Ralph flags a significant new trend: purpose-built rental buildings. These larger developments face financial pressure due to softening rental rates and increasing competition, affecting landlord profitability.

With rental listings up significantly (18.5%), tenants now have more choices, which could further soften rental prices in the coming months, noting the emergence of new rental options, changing the market dynamic considerably.

While headlines suggest turmoil, Toronto’s market remains surprisingly steady. Prices and sales indicate resilience, especially for low-rise homes and larger condo units. But do expect choppy waters ahead due to these broader economic factors (ugh, only so much we can control). If you’re feeling uncertain, stressed or anxious, reach out – the Fox Marin team is always around for candid conversations and practical real estate advice (we’ve got you covered).

Enjoyed this overview of Toronto’s housing market? For ongoing updates, expert analysis, and real talk about navigating real estate amid uncertainty, subscribe to the Fox Marin YouTube channel.

Subscribe now – we promise clarity (and a bit of fun) in every video!

Contact us (We’re Nice).

Fox Marin has earned its reputation as Toronto’s premier downtown luxury real estate team, backed by over *$580 million in sales, more than 1,000 successful transactions, and over 450 glowing 5-star Google Reviews. Discover the advantage of working with a proven team with a track record for winning results.

(*Source: Jan. 1, 2018 – Sept 1, 2025, RE Stats Inc. & Exclusive)

—

Kori Marin is a Toronto Broker & Managing Partner at Fox Marin Associates. For high-energy real estate aficionado Kori Marin, a well-lived life is achieved by maintaining an “all-in” attitude that realizes every last ounce of one’s full potential. This mindset has driven successful results in every aspect of her life – from her corporate sales and account management experience to her international travels to her years of fitness training and leadership – and is the hallmark of the exceptional work that she does on behalf of her clients in the residential real estate sector in downtown Toronto.