Has The Toronto Bubble Finally, Popped?

If you were an active landlord or tenant in 2018, you’ve probably joined the chorus of criticism or maybe even delight (depending on which hat you wear), in respect to the state of the Toronto rental market.

Fact is, the demand for rentals in Ontario has reached multi-decade highs. This is a function of robust economic and population growth, job creation, limited supply and a profusion of individuals priced out of the home ownership market. However, after seeing unprecedented growth since 2010, the Toronto rental market is finally expected to “ease” in 2019.

Urbanation’s President, Shaun Hildenbrand, is projecting an average rental price increase of about 5% for this year. And, this is considered a “slow-down,” especially in comparison to the data from 2017 and 2018.

According to Urbanation’s rental report, the cost of renting in Toronto jumped 9.3% to $2,309 in 2018. This breaks the record 8.3% growth that was measured in 2017. More than this, it is the biggest yearly gain since the condo research firm began tracking the market in 2010. And, it’s more than double the 4.1% average over the past eight years.

As Toronto renters faced tight market conditions in 2018, they began to compromise in terms of unit type and location. This resulted in the average rent for even studio apartments to rise above $1,800 a month. And, the number of units that are leasing below $1,800 has virtually dropped off almost entirely. Meanwhile, the number of condos that rented for $2,500 per month or more rose by a staggering 43%.

In my opinion? These numbers are demonstrably not sustainable! The average tenant’s income alone is around $65,000 annually. With this, income growth has barely been keeping up with the rapid rate of rent inflation. The cost of living continues to go up with each minimum wage hike alone. And, we’re in an era of extreme pressures to indulge in 5-star dinners and luxury vacations to keep up with the status quo. Because of this, we’re going to start to see a lot more people going into debt. Or, they look to borrow from the bank of mom and dad to make ends meet.

Think about it this way, an annual salary of $65,000 can comfortably afford a monthly rent of $1,895. This is 35% of their income. However, downtown studios are renting closer to the $2,000 mark today, forcing the average individual to look at alternative options. They look for a roommate and forego the luxury of having more than one room in their living space. Or, they turn to outside markets of the City of Toronto, where leases grew 40% year-over-year in Q4 of 2018. After taxes, car and living expenses – and surprise phone bills (amiright?) – there isn’t much left over for disposable income.

While a 5% increase on top of these numbers today may seem like a daunting number for some tenants, there is good news that may herald opportunities for renters looking to transition into home ownership.

Shaun Hildenbrand notes, “the emerging slowdown in rent increases will be a first step towards calming condo-price growth, which has faced continued upward pressure, partly due to investors looking to buy units and rent them out.”

So far, the majority of current supply growth we’ve seen for rentals has been comprised of secondary units offered by investors in the condominium market.

As the costs of construction continue to rise and put pressure on pre-sales, condo investors will find it more and more challenging to see returns. This is especially true when purchasing at the pre-construction stage at the cost of $1,000+ per sqft. There is a direct correlation between rentals and home prices, and it is not a coincidence they tend to move in the same direction.

Furthermore, another recent change affecting the Toronto rental market is the abolishment of rent control for new construction inventory. This is good news for developers who are releasing new purpose-built projects in 2019. And, will further incentivize the creation of more rental focused inventory in years to come. This is where the city’s priority needs to be – increasing supply. In 2019 alone, nearly 5,000 purpose-built rental apartments are expected for completion, representing the highest level since the early 1990s.

There’s been a record number of new condo inventory in 2019, paired with greater sacrifices displayed by current renters. With this in mind, here are some key reasons we’re expecting a slow down in this year’s rental market:

Lease activity in the suburbs of Toronto jumped 40% in the fourth quarter from a year earlier. More and more renters are now sprawling outside of the city limits for more affordable rental housing. Because of this, it’ll help contribute to more balanced conditions in the downtown core. This is good news for the immediate future. However, demand-focused solutions will only alleviate the problem temporarily as the city’s population continues to grow.

In Q4-2018, the increase to rent hit a record rate of 11.3% on a per sqft basis. The average rental unit size fell to a record low of 709 sqft and studio leases jumped 44%. With units getting smaller and smaller, it will push out those looking for more room or wish to raise a family in the downtown core. The pragmatic point here is that smaller units mean we can accommodate more individuals in a smaller footprint. High-density planning is critical for any growing city, especially ones with a protected greenbelt limiting sprawl and developable land.

A total of 6,216 units were completed in the fourth quarter of 2018. This is a trend we expect to continue in 2019 as a record of over 20,000 new condos reach completion. Following a period of exceptionally low new supply, this is also a record high in two years. With greater competition among rental properties for lease and more options for renters, this eliminates the likelihood of bidding wars. It also reduces rapid turnovers on listings, putting less stress on renters desperate to find a property.

The average vacancy rate for rental apartments completed in the Toronto region since 2005 was 0.6%. Today, the total number of purpose-built rental apartments under construction in the GTA reach more than 30-year high with close to 5,000 purpose-built rentals expected to reach completion in 2019. This will also help strategically combat our supply problem as more and more people get priced out of the resale market. There is a need to designate available rental options to accommodate them. After all, everyone needs a place to live.

While Urbanation’s Shaun Hildebrand agrees that he expects rents to moderate going into 2019 as more apartments and condos become available, in the short-term he warns, “the demand from a growing population and consumers shut out of the home ownership market continue to outstrip the supply for rentals and push up the cost of leasing.”

Further, Ben Myers, President of Bullpen Research & Consulting Inc., adds, “low vacancies and higher rents are trends that will carry over from 2018”. And with this, increased immigration and “renovictions” will continue to become issues amongst landlords and tenants.

So, while increasing purpose-built and condo rental supply paired with changing consumer behaviour should slow the rate of rent growth in 2019, it ultimately won’t be enough to push prices down.

If you are going to take one thing away from this article, it should be that these changes are only short-term solutions to a much bigger problem: our city’s infrastructure and housing supply simply cannot support or keep up with the growing population. So, while these changes will alleviate some of the congestion we have been seeing, there is no short-term solution for this long-term problem.

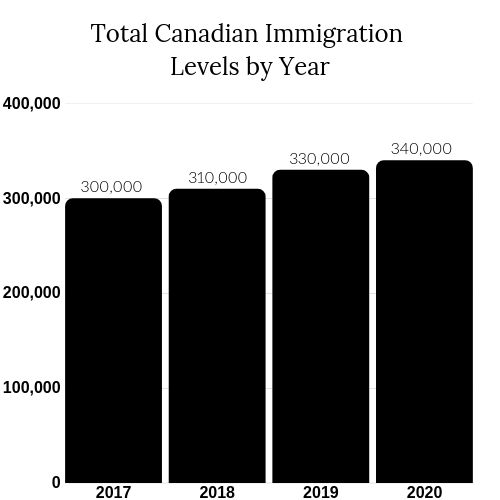

The Liberal government plans to welcome nearly one million immigrants to Canada between 2017-2020 alone and, Toronto is still a top choice for immigrants, and they all need a place to live.

The problem is screaming in our faces at every level: traffic jams, TTC woes, impossible restaurant reservations, lineups left, right, and centre – at times it feels like we are bursting at the seams. As such, as we continue on this trajectory, prices in the long-term on both the rental and resale end will continue to rise significantly and will permeate into the outer suburban markets. So, if you have been on the fence on whether or not you should make your big move on your next real estate acquisition, the best time was 20 years ago, but the second best time is NOW!

Get in touch with our team today to partner with us on your next acquisition. We’ll make sure to inform and protect you, to help maximize all opportunities for big-time wins!

—

This article is written by Urban enthusiast and food/travel junkie, Jessica Elizabeth Spillas. As the firm’s multi-talented Business Development Manager and Sales Representative, she is able to pair her passionate approach to buying, selling and investing in Toronto Real Estate with her flair for design and digital marketing. With this in mind, Jessica delivers unparalleled service with every interaction and works hard to keep her clients and colleagues organized and working at top-notch efficiency.